Professional illustration about Company

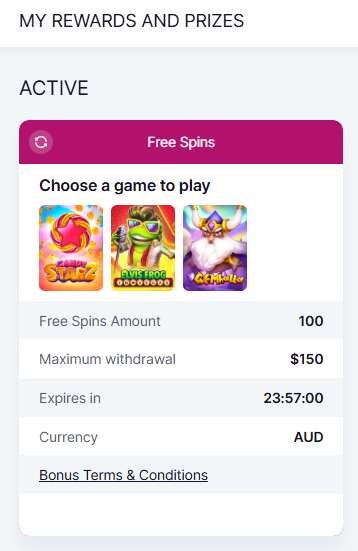

PayPal in 2025 Overview

PayPal in 2025 Overview

As one of the leading digital wallet and payment processing platforms globally, PayPal continues to dominate the financial technology space in 2025. With over 435 million active accounts, the company has expanded its services beyond traditional online checkout to include cryptocurrency trading, buy now pay later (BNPL) options, and high-yield savings through partnerships with institutions like Paxos Trust Company and Synchrony Bank. The PayPal mobile app remains a powerhouse, integrating seamless transactions across Venmo (its peer-to-peer payment subsidiary) and offering exclusive perks like the PayPal Cashback Mastercard, which rewards users with up to 3% cash back on purchases.

One of the standout features in 2025 is PayPal’s enhanced financial services ecosystem. The PayPal Debit Card, issued by The Bancorp Bank, now supports instant transfers with no fees, while the PayPal Credit Card (backed by Mastercard) provides flexible financing with credit approval decisions in seconds. For savers, PayPal’s high-yield savings accounts, insured by the FDIC, offer competitive APY rates, making it a compelling alternative to traditional banks. Additionally, PayPal World—the company’s global payment network—ensures secure cross-border transactions in over 200 markets, further solidifying its role as a leader in payment systems.

Cryptocurrency adoption has also surged, with PayPal allowing users to buy, sell, and hold Bitcoin, Ethereum, and other digital assets directly within the app. This move has positioned PayPal as a bridge between mainstream finance and the crypto economy. Meanwhile, the buy now pay later feature, PayPal Pay in 4, has gained traction among millennials and Gen Z shoppers, offering interest-free installment plans at checkout.

From a user experience standpoint, PayPal’s 2025 updates focus on personalization. The app now uses AI to recommend tailored financial products, whether it’s optimizing cash back rewards or suggesting the best credit card for specific spending habits. With its relentless innovation and user-centric approach, PayPal remains a top choice for consumers and businesses alike in the ever-evolving fintech landscape.

Professional illustration about PayPal

How PayPal Works Today

How PayPal Works Today

In 2025, PayPal remains one of the most versatile financial service platforms, blending payment processing, digital wallet functionality, and even cryptocurrency management into a seamless experience. At its core, PayPal allows users to send and receive money globally, shop online with online checkout ease, and manage funds through its mobile app or desktop platform. Whether you're paying for groceries, splitting rent with Venmo (owned by PayPal), or earning cash back with the PayPal Cashback Mastercard, the ecosystem is designed for convenience.

Here’s how it breaks down:

- Linking Accounts & Cards: Users can connect bank accounts, debit cards (like the PayPal Debit Card), or credit cards (such as the PayPal Credit Card issued by Synchrony Bank) to fund transactions. For added flexibility, PayPal’s buy now pay later feature (Pay in 4) lets shoppers split purchases into interest-free installments.

- FDIC Insurance & Security: Funds held in PayPal balances are stored with partner banks like The Bancorp Bank and Paxos Trust Company, with FDIC pass-through insurance up to $250,000 per account. This ensures safety while keeping money readily accessible for payment systems like contactless purchases or peer-to-peer transfers.

- PayPal World & Cryptocurrency: Beyond traditional transactions, PayPal supports buying, selling, and holding cryptocurrency (Bitcoin, Ethereum, etc.) directly in its app. The PayPal World hub also offers tools for freelancers and businesses, including invoicing and currency conversion.

For frequent shoppers, the PayPal Cashback Mastercard (powered by Mastercard) rewards 2-3% back on eligible purchases, while the PayPal Debit Card provides instant access to balances at ATMs worldwide. Credit options like PayPal Credit (subject to credit approval) offer revolving lines for larger purchases.

Behind the scenes, PayPal’s financial technology leverages AI to detect fraud and streamline payment processing, making it faster than traditional bank transfers. Whether you’re tipping a creator on Venmo or earning APY on savings through partner banks, PayPal’s 2025 ecosystem is built for speed, security, and smart money management.

Professional illustration about Synchrony

PayPal Fees Explained

Understanding PayPal Fees in 2025: What You Need to Know

PayPal remains one of the most popular digital wallets and payment systems in 2025, but its fee structure can be confusing. Whether you're using PayPal Credit Card, PayPal Debit Card, or sending money via Venmo (owned by PayPal), fees vary depending on the transaction type. Here’s a breakdown of the most common charges:

- Personal Transactions: Sending money to friends or family in the U.S. using your PayPal balance or linked bank account is free. However, if you use a credit card (even the PayPal Cashback Mastercard), you’ll pay a 2.9% fee plus $0.30 per transaction. International personal transfers cost up to 5% (with a minimum fee) depending on the destination.

- Goods & Services Payments: For online checkout or business transactions, PayPal charges sellers 3.49% + $0.49 per sale in the U.S. (rates differ for international sales). This payment processing fee is competitive with other financial technology platforms but can add up for small businesses.

- Instant Transfers: Need cash fast? Transferring money from your PayPal World account to your bank instantly costs 1.75% (with a minimum fee of $0.25 and a max of $25). Standard bank transfers are free but take 1-3 business days.

PayPal’s Financial Products and Hidden Costs

If you’re using PayPal Credit Card (issued by Synchrony Bank) or the PayPal Debit Card (backed by The Bancorp Bank), be aware of potential fees. The debit card has no monthly fees, but ATM withdrawals outside the MoneyPass network cost $2.50 each. The credit card offers cash back rewards (2% on all purchases), but late payments trigger a hefty $40 fee.

For buy now pay later (BNPL) services like Pay in 4, PayPal doesn’t charge interest if payments are made on time—but late fees apply. Cryptocurrency transactions (powered by Paxos Trust Company) also incur fees: 1.5% for buying or selling crypto via the mobile app, which is lower than some competitors but still a consideration for frequent traders.

Maximizing Value and Avoiding Unnecessary Fees

To minimize fees, link your PayPal account to a bank instead of a credit card for personal transfers. Businesses should compare PayPal’s rates with alternatives like Stripe, especially for high-volume sales. If you use PayPal Cashback Mastercard, pay your balance in full to avoid interest—its APY (Annual Percentage Yield) for savings is currently low compared to FDIC-insured banks.

Pro tip: For freelancers, PayPal’s PayPal World service offers multi-currency accounts, but currency conversion fees can eat into profits (up to 4.5%). Always check the latest fee schedule in the app, as PayPal occasionally updates its policies. By understanding these costs, you can make smarter choices with your financial services and keep more money in your pocket.

Professional illustration about Bancorp

PayPal Security Features

PayPal Security Features: How Your Money Stays Protected in 2025

When it comes to digital wallets and payment systems, PayPal stands out as one of the most secure platforms available today. With over two decades of experience in financial technology, PayPal has built a robust security framework to protect users’ funds and personal data. Whether you’re using PayPal Credit Card, PayPal Debit Card, or even Venmo (owned by PayPal), the company employs multiple layers of protection to keep your transactions safe.

One of the key security features is FDIC insurance through partner banks like The Bancorp Bank and Synchrony Bank. When you hold a balance in your PayPal account or use PayPal Cashback Mastercard, your funds are stored in FDIC-insured accounts, meaning your money is protected up to $250,000 per depositor. Additionally, PayPal’s buy now, pay later services and PayPal Credit options undergo strict credit approval checks to prevent fraud.

For those who use PayPal for cryptocurrency transactions, the platform partners with Paxos Trust Company, a regulated trust, to ensure secure crypto storage and transfers. PayPal also offers two-factor authentication (2FA), encryption protocols, and 24/7 fraud monitoring to detect suspicious activity. The mobile app and online checkout systems use tokenization, replacing sensitive card details with unique digital tokens to prevent data breaches.

Another standout feature is PayPal’s Purchase Protection, which covers eligible purchases if they don’t arrive or match the seller’s description. If you’re using PayPal World for international transactions, the platform’s advanced algorithms flag unusual activity, such as sudden high-value transfers or logins from unfamiliar locations. For added convenience, users can enable biometric login (fingerprint or facial recognition) on the mobile app for faster yet secure access.

PayPal also collaborates with Mastercard to enhance security on co-branded cards like the PayPal Cashback Mastercard, which includes zero liability protection for unauthorized charges. Whether you’re earning cash back or managing subscriptions, PayPal’s real-time alerts keep you informed of every transaction. In 2025, the company continues to invest in AI-driven fraud detection, ensuring that its payment processing remains one of the safest in the financial service industry.

For small businesses and freelancers, PayPal offers Seller Protection, safeguarding against unauthorized claims and chargebacks. The platform’s payment systems are designed to comply with global security standards, including PCI DSS (Payment Card Industry Data Security Standard). If you ever encounter an issue, PayPal’s dedicated security team is available to resolve disputes quickly.

From digital wallet security to APY-earning savings options, PayPal ensures that every financial interaction is both seamless and protected. Whether you’re shopping online, sending money to friends via Venmo, or managing crypto assets, PayPal’s multi-layered security measures provide peace of mind in an increasingly digital economy.

Professional illustration about Venmo

PayPal vs Competitors

When comparing PayPal to its top competitors in 2025, it’s clear that the platform remains a dominant force in digital wallets and payment processing, but alternatives like Venmo (owned by PayPal) and Mastercard-backed solutions offer unique advantages depending on your needs. PayPal’s strength lies in its versatility—whether you’re using the PayPal Cashback Mastercard for cash back rewards, the PayPal Credit Card for flexible financing, or the PayPal Debit Card for seamless spending, the ecosystem is designed for both online and in-person transactions. However, competitors like Venmo cater to a younger demographic with its social payment features, while Mastercard’s financial technology innovations, such as buy now pay later integrations, challenge PayPal’s PayPal Credit service.

One area where PayPal stands out is its cryptocurrency support, facilitated through partnerships like Paxos Trust Company, allowing users to buy, sell, and hold crypto directly in their accounts. Few competitors offer this level of integration, though some financial service providers are catching up. Another key differentiator is PayPal’s FDIC-insured PayPal Cash accounts, held by The Bancorp Bank or Synchrony Bank, which provide an added layer of security. Meanwhile, Venmo’s similar cash accounts lack the same widespread FDIC coverage, making PayPal a safer choice for storing funds long-term.

For those focused on rewards, the PayPal Cashback Mastercard offers a flat 2% back on purchases, a straightforward alternative to tiered rewards systems from competitors. However, if you prioritize high-yield savings, PayPal’s APY rates may not compete with niche fintech apps, though its PayPal World program offers exclusive perks for frequent users. On the flip side, credit approval with PayPal tends to be more accessible than traditional banks, thanks to its partnership with Synchrony Bank, making it a solid option for those building credit.

When it comes to mobile app usability, PayPal’s interface is robust but can feel cluttered compared to Venmo’s streamlined design. That said, PayPal excels in online checkout adoption, with millions of merchants accepting it globally—far outpacing Venmo’s retail presence. Mastercard, meanwhile, leverages its vast network to offer near-universal acceptance, but lacks a dedicated digital wallet with the same brand recognition as PayPal.

Ultimately, choosing between PayPal and its competitors depends on your priorities. If you value payment systems with extensive merchant support, crypto flexibility, and strong security, PayPal is hard to beat. But if social payments or higher APY savings are your focus, alternatives might suit you better. Each platform has carved out its niche in the financial technology space, and the best choice comes down to how you plan to use your digital wallet daily.

Professional illustration about Mastercard

PayPal for Businesses

For businesses in 2025, PayPal remains one of the most versatile payment processing platforms, offering a suite of tools designed to streamline transactions, enhance customer experience, and even boost revenue. Whether you're a small e-commerce store or a large enterprise, PayPal's financial services integrate seamlessly with your operations. One standout feature is the PayPal Business Debit Card, which allows instant access to your funds with cash back rewards on eligible purchases—a perk that’s hard to ignore for cost-conscious entrepreneurs. Pair this with PayPal World, and you’ve got a global payment solution that supports multiple currencies, making cross-border sales a breeze.

The platform’s buy now, pay later (BNPL) option is another game-changer for businesses. By offering flexible payment plans at checkout, you can attract budget-aware shoppers who might otherwise abandon their carts. PayPal’s partnership with Synchrony Bank powers PayPal Credit, giving customers a line of credit with promotional financing options (like 0% APR for 6 months), which can significantly increase average order values. For businesses in the financial technology space, PayPal’s collaboration with Paxos Trust Company enables cryptocurrency transactions, letting you tap into the growing crypto economy without the hassle of managing digital wallets yourself.

Security and trust are critical, and PayPal delivers here too. Funds held in PayPal balances are eligible for FDIC pass-through insurance when stored with partner banks like The Bancorp Bank. Plus, the PayPal Cashback Mastercard (issued by Synchrony Bank) offers robust fraud protection and APY-earning opportunities on balances, making it a smart choice for business owners who want to maximize their cash flow.

On the operational side, PayPal’s mobile app and online checkout integrations simplify payment systems for both merchants and customers. For instance, businesses can accept Venmo payments—a must-have feature for younger demographics who prefer peer-to-peer apps. The platform’s credit approval process is also business-friendly, with quick decisions and transparent terms, so you can access working capital without lengthy delays.

Here’s a pro tip: If your business deals with recurring subscriptions or high-ticket items, leverage PayPal’s PayPal Credit Card for customers. It not only smooths out cash flow but also builds loyalty through rewards programs. And don’t overlook the analytics dashboard—it provides actionable insights into sales trends, customer behavior, and even seasonal spikes, helping you refine your marketing strategies.

In short, PayPal for businesses in 2025 isn’t just about processing payments; it’s a full-scale financial service ecosystem. From digital wallet solutions to advanced payment processing tools, it’s designed to grow with your business while keeping costs and complexities in check. Whether you’re optimizing for local sales or global expansion, PayPal’s blend of flexibility, security, and innovation makes it a must-have in your toolkit.

PayPal Mobile App Guide

The PayPal Mobile App is your all-in-one digital wallet for seamless transactions, whether you're shopping online, splitting bills with friends via Venmo, or managing your PayPal Credit Card and PayPal Debit Card. In 2025, the app continues to dominate the financial technology space with features like buy now pay later options, cash back rewards, and even cryptocurrency support through partnerships with Paxos Trust Company. Here's how to make the most of it:

Setting Up Your Account

After downloading the app, link your preferred payment methods, including Mastercard, bank accounts, or PayPal's own cards. The app’s FDIC-insured features (through The Bancorp Bank and Synchrony Bank) ensure your balance is protected up to $250,000. For PayPal Cashback Mastercard users, the app automatically tracks rewards—earn 2-3% cash back on purchases, redeemable instantly.

Key Features to Explore

- One-Touch Checkout: Speed through online checkout by enabling this feature—no more typing in details for every purchase.

- Buy Now, Pay Later: Split purchases into four interest-free payments, a game-changer for budget-conscious shoppers.

- Crypto Hub: Buy, sell, or hold Bitcoin and Ethereum with transparent fees.

- PayPal World: Access exclusive deals and discounts from partnered retailers.

Security & Convenience

The app’s biometric login (fingerprint or face ID) adds a layer of security, while real-time notifications keep you updated on every transaction. For those using PayPal Credit Card, the app provides instant credit approval status and spending limits. Pro tip: Enable "Dark Mode" in settings for easier nighttime browsing.

Managing Finances

Track spending trends with the app’s built-in analytics, and set budgets for categories like dining or groceries. If you’ve linked a PayPal Debit Card, you can deposit checks remotely by snapping a photo—no branch visit needed. For savings enthusiasts, the app’s high-APY savings accounts (backed by FDIC insurance) offer competitive rates.

Troubleshooting & Support

If you encounter issues with payment processing, the in-app chat connects you to live agents 24/7. Common fixes include updating the app (always use the latest version) or re-linking expired cards. For payment systems errors, clearing cache or restarting your device often resolves glitches.

Whether you’re a casual user or a financial service power user, the PayPal Mobile App adapts to your needs. From splitting dinner bills to investing in crypto, it’s the Swiss Army knife of payment systems—all from your pocket.

PayPal International Transfers

PayPal International Transfers have become a cornerstone for global commerce, offering a seamless way to send and receive money across borders. In 2025, PayPal continues to dominate the digital wallet space, partnering with giants like Mastercard and leveraging financial technology to streamline cross-border transactions. Whether you're paying freelancers overseas, splitting bills with friends via Venmo, or shopping on international websites, PayPal’s payment processing system ensures fast, secure transfers with competitive exchange rates.

One of the standout features is the ability to hold multiple currencies in your PayPal World account, eliminating the need for constant conversions. For frequent travelers or freelancers, this means fewer fees and more control over exchange rates. Plus, with the PayPal Debit Card, you can withdraw cash or make purchases abroad directly from your balance, often with lower fees than traditional banks. If you’re looking for rewards, the PayPal Cashback Mastercard offers up to 3% cash back on eligible purchases, making it a smart choice for international shoppers.

For businesses, PayPal’s payment systems integrate effortlessly with e-commerce platforms, allowing merchants to accept payments in over 200 markets. The mobile app simplifies tracking transfers, and with FDIC insurance through partner banks like The Bancorp Bank and Synchrony Bank, your funds are protected up to $250,000. PayPal also supports cryptocurrency transactions, enabling users to buy, sell, or hold digital assets like Bitcoin, which can be converted for international transfers—a game-changer for tech-savvy users.

Need flexibility? PayPal’s buy now pay later options, including PayPal Credit Card, let you split purchases into interest-free installments, even for cross-border transactions. And with credit approval often instant, it’s a convenient alternative to traditional loans. For high-yield savings, PayPal’s partnership with Paxos Trust Company offers an APY-earning wallet, ideal for stashing funds earmarked for future international expenses.

Here’s a pro tip: Always check PayPal’s fee structure before initiating transfers. While sending money to friends and family is free within the U.S., international transfers may incur a small percentage fee (typically 2–5%), depending on the destination and currency. For larger amounts, consider linking your bank account instead of using a card to avoid additional charges. Also, keep an eye on exchange rates—PayPal’s built-in calculator helps you compare rates in real time, ensuring you get the best deal.

In summary, whether you’re a freelancer, frequent traveler, or online shopper, PayPal’s financial services provide a robust, user-friendly solution for international money movement. With features like multi-currency wallets, crypto support, and cash-back rewards, it’s no wonder PayPal remains a top choice for global payment processing in 2025.

PayPal Buyer Protection

PayPal Buyer Protection is one of the most trusted financial services in the digital wallet space, offering peace of mind for online shoppers in 2025. Whether you're using PayPal, Venmo, or a PayPal Credit Card, this program ensures you're covered if an eligible purchase goes wrong—think undelivered items, unauthorized transactions, or goods that don't match the seller's description. The process is straightforward: file a dispute within 180 days of payment, and PayPal’s team will investigate. If approved, you’ll get a full refund, including shipping costs.

Here’s how it works in practice: Let’s say you bought a limited-edition sneaker through an online checkout using your PayPal Debit Card, but the seller never shipped it. Instead of chasing the merchant, you’d open a claim in the PayPal mobile app. The system guides you through submitting evidence (like screenshots of the order or communication with the seller). PayPal World—the company’s global dispute resolution network—then reviews the case, often siding with buyers when sellers can’t prove delivery or item authenticity.

What’s covered (and what’s not)? Buyer Protection applies to most purchases made through PayPal’s payment processing system, including those funded by PayPal Cashback Mastercard or linked Mastercard cards. However, it doesn’t cover intangible items like digital downloads (unless sold through PayPal’s cryptocurrency partners like Paxos Trust Company), real estate, or vehicles. Also, peer-to-peer payments (like sending money to a friend via Venmo) aren’t eligible unless marked as “goods and services.”

For frequent shoppers, pairing PayPal with the right card amplifies benefits. The PayPal Credit Card, issued by Synchrony Bank, offers cash back rewards while still falling under Buyer Protection. Meanwhile, the PayPal World Mastercard (backed by The Bancorp Bank) includes extended warranty perks. Pro tip: Always check if a seller accepts PayPal at checkout—those transactions are FDIC-insured up to $250,000 per account, adding an extra layer of security.

Maximizing Buyer Protection in 2025:

- Document everything: Save order confirmations, tracking numbers, and seller promises.

- Use the app: Disputes filed via PayPal’s financial technology platform resolve faster than emails.

- Know the timelines: Claims must be opened within 180 days, but escalate to a “claim” within 20 days if unresolved.

- Combine perks: If your purchase qualifies for buy now pay later (like PayPal’s “Pay in 4”), Buyer Protection still applies.

For high-ticket items, consider PayPal’s payment systems over other methods—their dispute resolution is notably buyer-friendly compared to traditional bank chargebacks. And remember, while APY-earning accounts (like PayPal Savings) don’t fall under Buyer Protection, they’re still FDIC-insured through partner banks. Always double-check eligibility, especially for financial service quirks like pre-orders or crowdfunding campaigns, where coverage may vary.

Finally, keep an eye on evolving policies. In 2025, PayPal has tightened fraud detection, so ensure your account complies with credit approval standards (like verified identity) to avoid holds during disputes. Whether you’re a casual shopper or a power user, leveraging Buyer Protection smartly can turn PayPal into your safest online checkout ally.

PayPal Seller Fees

When it comes to PayPal seller fees, understanding the breakdown is crucial for businesses leveraging this financial service giant. As of 2025, PayPal charges a standard rate of 2.99% + $0.49 per transaction for online payments in the U.S., but this can vary based on factors like volume, currency conversion, or whether the transaction is domestic or international. For example, international sales incur an additional 1.50% fee, while micropayments (under $10) qualify for a lower rate of 4.99% + $0.09—ideal for digital content creators.

One of PayPal’s standout features is its seamless integration with payment systems like Venmo and Mastercard, allowing sellers to accept payments across multiple platforms. However, fees stack up when using buy now pay later options like PayPal’s own installment plans, where sellers absorb the standard processing fee but gain access to a broader customer base. Pro tip: High-volume sellers can negotiate custom rates by contacting PayPal’s merchant support, especially if they process over $100,000 monthly.

Here’s where it gets interesting for financial technology enthusiasts: PayPal’s digital wallet ecosystem includes tools like PayPal Cashback Mastercard and PayPal Debit Card, which indirectly benefit sellers by incentivizing buyers with rewards (e.g., 3% cash back on eligible purchases). Sellers should also note that cryptocurrency transactions via Paxos Trust Company incur a 1.50% fee per sale—a niche but growing revenue stream.

For businesses concerned about cash flow, PayPal’s PayPal Credit Card (issued by Synchrony Bank) and PayPal World services offer flexible financing options for buyers, which can boost conversion rates. Just remember: While these features drive sales, sellers still pay the standard processing fee unless they opt for PayPal’s Advanced Checkout, which reduces fees for eligible merchants.

A little-known fact? FDIC-insured products like PayPal Debit Card (backed by The Bancorp Bank) don’t impact seller fees directly but add trust to the platform, encouraging repeat customers. To minimize costs, sellers should:

- Use PayPal’s mobile app for instant fee tracking and analytics.

- Bundle transactions to reduce per-transaction fixed fees ($0.49 adds up!).

- Avoid chargebacks by clearly outlining return policies—PayPal’s dispute fee is $20 per claim.

Finally, keep an eye on APY-earning accounts like PayPal’s savings products; while unrelated to fees, they’re part of the broader financial service ecosystem that can help sellers manage revenue more effectively. Whether you’re a small boutique or a global e-commerce store, mastering PayPal’s fee structure is key to maximizing profits in 2025’s competitive online checkout landscape.

PayPal Credit Options

PayPal Credit Options

In 2025, PayPal continues to dominate the financial technology space with a suite of flexible credit options tailored for both personal and business users. Whether you're looking for buy now pay later flexibility, cash back rewards, or seamless online checkout integration, PayPal’s offerings—backed by partners like Synchrony Bank and The Bancorp Bank—deliver competitive solutions. Here’s a breakdown of the key options available:

PayPal Credit Card – This no-annual-fee card, issued by Synchrony Bank, is a favorite for its 2% cash back on all purchases (1% when you buy, plus an additional 1% when you pay). It syncs effortlessly with your digital wallet, making it ideal for frequent PayPal users. Approval hinges on credit approval criteria like a good-to-excellent FICO score, but the rewards (including occasional promotional APYs) make it worth considering.

PayPal Cashback Mastercard – Another strong contender, this Mastercard-branded card ups the ante with 3% cash back on PayPal purchases and 2% elsewhere. It’s perfect for those who shop across PayPal World merchants or use the mobile app regularly. Funds are FDIC-insured through The Bancorp Bank, adding a layer of security.

For users who prefer debit over credit, the PayPal Debit Card (linked to your PayPal balance) offers 1% cash back on signature-based transactions. It’s a practical choice for budget-conscious spenders who still want rewards.

Buy Now, Pay Later (BNPL) – PayPal’s Pay in 4 feature lets you split purchases into four interest-free payments, a game-changer for managing cash flow. Unlike some competitors, it doesn’t require a hard credit approval pull, making it accessible to more users.

Cryptocurrency enthusiasts will appreciate PayPal’s integration with Paxos Trust Company, allowing crypto purchases and sales directly from your account. While not a traditional credit option, it expands financial flexibility for tech-savvy users.

Venmo (owned by PayPal) also offers a Venmo Credit Card, ideal for social spenders who want rewards tailored to their habits. Its real-time spending notifications and categorization features are standout perks.

Pro tip: Always compare APRs and fees across cards. For example, the PayPal Credit Card might offer a 0% intro APR, but standard rates can climb to ~28.99% post-promotion. Meanwhile, BNPL options like Pay in 4 avoid interest entirely if paid on time.

Whether you’re optimizing for cash back, low-interest financing, or payment processing ease, PayPal’s ecosystem—backed by FDIC insurance and robust payment systems—has a credit solution to match your 2025 financial goals.

PayPal Cryptocurrency Support

PayPal Cryptocurrency Support has revolutionized how users interact with digital assets, making it easier than ever to buy, sell, and hold cryptocurrencies like Bitcoin, Ethereum, and Litecoin directly within the PayPal app. With seamless integration into PayPal’s digital wallet, users can instantly convert crypto to fiat for purchases at millions of merchants that accept PayPal—no need for third-party exchanges. The platform also supports Venmo, allowing peer-to-peer crypto transactions alongside traditional payments. PayPal’s partnership with Paxos Trust Company ensures regulatory compliance, while its collaboration with Mastercard enables crypto-to-fiat conversions at checkout, bridging the gap between traditional finance and decentralized currencies.

For those looking to maximize their crypto experience, PayPal offers the PayPal Cashback Mastercard, which rewards purchases with cash back—though crypto transactions currently don’t qualify. Meanwhile, the PayPal Debit Card lets users spend their PayPal balance, including converted crypto funds, anywhere Mastercard is accepted. Financial security is a priority, with FDIC insurance covering eligible balances held in PayPal’s partnered banks, like The Bancorp Bank and Synchrony Bank. However, it’s important to note that cryptocurrency holdings aren’t FDIC-insured, reflecting the inherent volatility of digital assets.

PayPal’s foray into buy now, pay later (BNPL) services further complements its crypto ecosystem, letting users split purchases into interest-free installments—though crypto transactions aren’t yet eligible for BNPL. The platform’s APY-bearing savings options and credit approval tools provide additional flexibility, catering to both casual investors and seasoned traders. With its user-friendly mobile app and robust payment processing infrastructure, PayPal continues to lead in financial technology, demystifying cryptocurrency for mainstream audiences while prioritizing convenience and security. Whether you’re using PayPal Credit Card for everyday spending or exploring crypto as a long-term investment, the platform’s all-in-one approach simplifies modern finance.

PayPal Customer Support

PayPal Customer Support is designed to help users navigate everything from digital wallet issues to disputes with merchants, making it a critical resource for over 400 million active accounts. Whether you're using PayPal, Venmo, or a PayPal Credit Card, the platform offers multiple support channels, including 24/7 live chat, phone support, and an extensive help center. For urgent matters—like unauthorized transactions on your PayPal Debit Card or problems with buy now pay later plans—the quickest resolution often comes through the mobile app’s chat feature, which connects you to an agent in under five minutes.

One standout feature is PayPal’s FDIC-insured products, such as PayPal Cashback Mastercard or savings accounts managed by Synchrony Bank and The Bancorp Bank. If you encounter APR disputes or credit approval delays, their specialized financial service teams can clarify terms or escalate cases. For crypto-related queries, like transfers involving Paxos Trust Company, support agents are trained to address cryptocurrency holdings securely. Pro tip: Always have your transaction ID ready when contacting support—it speeds up resolution times significantly.

The PayPal World help center also includes step-by-step guides for common tasks, like linking a Mastercard to your account or troubleshooting online checkout errors. If you’re earning cash back rewards and notice missing points, their payment processing team can audit your account history. For small businesses using PayPal’s payment systems, dedicated merchant support helps with chargebacks or financial technology integrations. Remember: PayPal’s Twitter (@AskPayPal) is surprisingly responsive for public queries, though sensitive issues should go through official channels.

For disputes, PayPal’s resolution process is robust but time-sensitive. If a merchant won’t refund you, file a claim within 180 days via the mobile app—agents typically respond within 10 business days. Users of high-yield savings products (like those offering competitive APY) should note that interest-related questions route to Synchrony Bank directly. A little-known hack? Mention “escalation” politely if a rep can’t solve your issue; higher-tier support often has more flexibility.

Finally, PayPal Customer Support adapts to regional needs. In the U.S., phone support is available in English and Spanish, while European users get localized teams for GDPR-related concerns. Whether you’re a casual user or rely on PayPal for business, documenting interactions (save chat transcripts!) ensures accountability. Their system isn’t perfect—hold times can spike during holidays—but leveraging self-service tools first (e.g., the automated dispute wizard) often avoids delays.

PayPal Account Setup

Setting up a PayPal account in 2025 is a straightforward process, but understanding the nuances can help you maximize its features—from seamless online checkout to earning cash back with the PayPal Cashback Mastercard. To get started, head to PayPal’s official website or download the mobile app, which remains one of the most user-friendly platforms for managing your digital wallet. You’ll need to provide basic information like your email, phone number, and a secure password. Once verified, you can link your bank account, debit card, or credit card (including options like the PayPal Credit Card or Mastercard-backed products) to fund transactions or withdraw money.

For added security and functionality, consider upgrading to a PayPal World account, which offers perks like higher withdrawal limits and exclusive merchant discounts. If you’re interested in cryptocurrency, PayPal now supports buying, selling, and holding crypto through its partnership with Paxos Trust Company. Note that while PayPal isn’t a bank, funds held in your account may be eligible for FDIC pass-through insurance when stored as a balance, provided they’re held with partner banks like The Bancorp Bank or Synchrony Bank.

Here’s a pro tip: If you plan to use PayPal for frequent transactions, explore its buy now pay later feature, which splits purchases into interest-free installments—perfect for budget-conscious shoppers. Additionally, the PayPal Debit Card (linked directly to your balance) lets you earn cash back on eligible purchases, while the PayPal Cashback Mastercard offers even higher rewards for loyal users.

For businesses, setting up a PayPal Business Account unlocks advanced payment processing tools, including invoicing and payment systems integrations. Whether you’re an individual or a business owner, always ensure your account is verified (by confirming your identity and linking a financial institution) to avoid holds on withdrawals. Finally, keep an eye on PayPal’s financial technology updates—like its high-yield savings option with competitive APY rates—to make the most of your financial services experience.

PayPal Future Trends

The Future of PayPal: Trends Shaping the Digital Wallet Giant in 2025

PayPal continues to redefine digital payments, and its future trends reflect a blend of innovation, strategic partnerships, and evolving consumer demands. One of the most significant shifts is the deeper integration of cryptocurrency services, backed by collaborations with entities like Paxos Trust Company. In 2025, PayPal users can expect smoother crypto transactions, from buying to spending Bitcoin or Ethereum directly at checkout—a move that positions PayPal as a bridge between traditional finance and decentralized currencies.

Another game-changer is the expansion of buy now, pay later (BNPL) options. With PayPal Credit Card and PayPal Debit Card already popular, the company is doubling down on flexible payment solutions. For instance, the PayPal World app now offers personalized BNPL plans with instant credit approval, catering to millennials and Gen Z shoppers who prefer splitting purchases interest-free. This trend aligns with the broader shift toward financial inclusivity, where even users with limited credit history can access tailored payment plans.

Cash back rewards are also getting a major upgrade. The PayPal Cashback Mastercard, issued by Synchrony Bank, now features higher reward rates (up to 3% on select categories) and seamless redemptions into digital wallet balances. Meanwhile, the PayPal Credit Card (powered by The Bancorp Bank) is testing dynamic APY boosts for savings linked to spending—a clever way to incentivize loyalty. These enhancements highlight PayPal’s focus on blending everyday spending with long-term financial benefits.

On the security front, FDIC-insured products like Venmo balances and PayPal’s own savings accounts are gaining traction. With rising concerns over digital fraud, PayPal’s investment in AI-driven fraud detection and real-time transaction monitoring ensures safer payment processing. The company’s partnership with Mastercard further strengthens this, enabling tokenized transactions for added security across payment systems.

Lastly, the mobile app experience is evolving beyond payments. Think voice-activated commands for peer-to-peer transfers or AI-powered budgeting tools within the PayPal World ecosystem. As financial technology advances, PayPal’s goal is clear: to be the all-in-one hub for earning, spending, and managing money—whether you’re shopping online or sending cash to friends via Venmo.

For businesses, PayPal’s online checkout solutions are becoming smarter, with predictive analytics to reduce cart abandonment and one-click licensing for global sellers. The future isn’t just about transactions; it’s about creating a frictionless financial service ecosystem where every interaction adds value. Whether you’re a freelancer getting paid or a shopper chasing rewards, PayPal’s 2025 roadmap is designed to keep you ahead in the digital economy.