Professional illustration about American

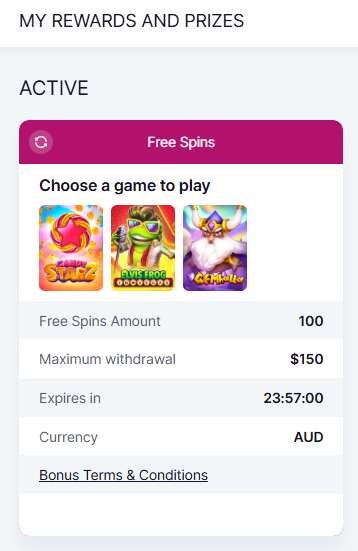

Gold Coin Types 2025

Here’s a detailed, SEO-optimized paragraph on Gold Coin Types 2025 in conversational American English, focusing on key entities and LSI terms:

When it comes to gold investment in 2025, understanding the different gold coin types is crucial for both collectors and investors. The Gold American Eagle remains a top choice for U.S. buyers, minted with 22-karat gold and backed by the U.S. government, making it a staple for wealth protection. Its sibling, the Gold American Buffalo, offers 24-karat purity, appealing to those seeking higher gold content. For international options, the Canadian Gold Maple Leaf stands out with its 99.99% purity and advanced security features like radial lines, while the South African Gold Krugerrand (the original modern bullion coin) continues to dominate markets with its durable 22-karat alloy. The Chinese Gold Panda is unique for its annually changing designs, making it a favorite among collectors, and the Mexican Gold Libertad boasts stunning imagery of winged Victory. Niche options like the Somalian Gold Elephant or the British Gold Britannia cater to specific themes, with the latter featuring Britannia’s iconic image and .9999 fineness. For classical music enthusiasts, the Austrian Gold Philharmonic celebrates Vienna’s orchestra with impeccable craftsmanship.

What sets these bullion coins apart? First, gold purity and weight matter—most coins range from 1/10 oz to 1 oz, with premiums varying by mint and demand. Second, liquidity: Coins like the Gold American Eagle or Krugerrand are globally recognized, ensuring easy resale. Third, consider gold IRA eligibility; many of these coins meet IRS standards for precious metals investment. For example, the Gold American Buffalo and Canadian Gold Maple Leaf are IRA-approved, while commemorative coins often aren’t. Storage is another factor—physical gold ownership requires secure solutions like home safes or vaults.

Pro tip: Always check the gold spot price before buying to avoid overpaying. Websites offering buy gold online services typically list live gold price charts. Diversify with a mix of coins and gold bullion bars to balance collectibility and pure investment value. Whether you’re hedging against inflation or building a tangible asset portfolio, 2025’s gold coin market offers something for every strategy.

Professional illustration about American

Investing in Gold Coins

Investing in gold coins is one of the most reliable ways to diversify your portfolio and protect your wealth against economic uncertainty. In 2025, gold bullion coins remain a top choice for investors seeking physical gold ownership due to their liquidity, recognized value, and government-backed purity. Popular options like the Gold American Eagle and Gold American Buffalo are minted by the U.S. government, guaranteeing their weight (1 oz, ½ oz, ¼ oz, or 1/10 oz) and purity (22-karat for Eagles, 24-karat for Buffalos). These coins are highly sought after not just for their gold investment potential but also for their collectible appeal.

For those looking beyond U.S. minted coins, international options like the Canadian Gold Maple Leaf (known for its 99.99% purity) and the South African Gold Krugerrand (the first modern bullion coin) offer excellent alternatives. The Chinese Gold Panda and Mexican Gold Libertad are also gaining traction due to their unique designs and limited annual mintages, making them attractive for both investors and collectors. Meanwhile, the British Gold Britannia and Austrian Gold Philharmonic provide additional diversification with their .9999 fine gold content and strong resale markets.

When considering precious metals investment, it’s crucial to understand key factors like gold purity, weight, and the gold spot price, which fluctuates daily. Unlike gold bullion bars, coins often carry a small premium due to their design and minting costs, but they’re easier to trade in smaller quantities. For long-term investors, a gold IRA can be a tax-advantaged way to hold physical gold, though it requires IRS-approved coins like the Gold American Eagle or Gold Maple Leaf.

Here are some practical tips for buying gold coins in 2025:

- Buy from reputable dealers: Avoid counterfeit risks by purchasing from trusted sources with verified authenticity.

- Check the gold price chart: Timing your purchase when the gold spot price dips can maximize value.

- Consider storage: Safe deposit boxes or insured home safes are essential for protecting your investment.

- Diversify holdings: Mixing coins like the Somalian Gold Elephant (known for its annual design changes) with more traditional options can balance liquidity and collectibility.

Whether you’re a first-time buyer or a seasoned investor, gold coins offer a tangible asset that historically preserves wealth. With options ranging from government-minted staples to exotic international issues, there’s a coin to fit every strategy—from wealth protection to speculative collecting. Just remember: physical gold is a long-term play, so focus on quality, liquidity, and secure storage to get the most out of your investment.

Professional illustration about American

Best Gold Coins 2025

When it comes to gold investment in 2025, choosing the best gold coins is crucial for both collectors and investors looking for wealth protection and long-term value. Among the top contenders, the Gold American Eagle and Gold American Buffalo remain iconic choices for U.S. buyers, backed by the U.S. Mint with .9167 purity (22-karat) and .9999 purity (24-karat), respectively. The American Eagle is particularly popular for its recognizable design and liquidity, while the American Buffalo appeals to those seeking the highest gold purity. For investors prioritizing gold purity, the Canadian Gold Maple Leaf stands out with its .9999 fine gold content and advanced security features, including micro-engraved radial lines to deter counterfeiting.

Internationally, the South African Gold Krugerrand continues to be a staple in precious metals investment, known for its historical significance and durability. Meanwhile, the Chinese Gold Panda offers a unique appeal with its annually changing designs, making it a favorite among collectors. The Mexican Gold Libertad, minted by Banco de México, is another standout for its stunning artwork and limited mintage, often driving higher demand. For those interested in gold bullion coins with a cultural twist, the Somalian Gold Elephant and British Gold Britannia combine artistic beauty with investment-grade gold, featuring .9999 purity and innovative anti-counterfeiting measures.

If you're diversifying your gold IRA or portfolio, consider the Austrian Gold Philharmonic, which celebrates the country’s musical heritage and is minted in .9999 fine gold. Its European popularity ensures easy liquidity in global markets. When evaluating gold coins, pay attention to the gold spot price and gold weight, as these factors directly impact value. For example, a 1-ounce Gold Maple Leaf will track the gold price chart more closely than fractional coins, which often carry higher premiums.

For investors who prefer buying physical gold ownership, here’s a quick comparison of key features:

- Gold American Eagle: 22-karat, widely recognized, high liquidity.

- Gold American Buffalo: 24-karat, purest U.S. option, ideal for purists.

- Canadian Gold Maple Leaf: .9999 purity, advanced security, low premiums.

- South African Gold Krugerrand: Durable, historic, 22-karat gold with copper alloy for strength.

- Chinese Gold Panda: Collectible, annual design changes, .999 purity.

Whether you’re looking to buy gold online or through a dealer, always verify authenticity and purchase from reputable sources. Gold bullion coins like these not only offer wealth protection but also serve as tangible assets in uncertain economic times. Keep an eye on market trends and consider mixing sovereign coins like the Gold Britannia or Gold Libertad with more traditional options to balance your portfolio. Remember, the best gold coins in 2025 combine liquidity, purity, and aesthetic appeal—so choose wisely based on your financial goals.

Professional illustration about American

Gold Coin Value Guide

When it comes to understanding the value of gold coins, several factors come into play, including gold purity, weight, design rarity, and current gold spot price. Popular bullion coins like the Gold American Eagle, Canadian Gold Maple Leaf, and South African Gold Krugerrand are widely recognized for their gold investment potential, but their values can vary significantly based on market conditions and collector demand. For example, the Gold American Eagle contains 22-karat gold (91.67% purity) with a slight premium over the spot price due to its legal tender status and iconic design. Meanwhile, the Gold American Buffalo boasts 24-karat purity (99.99% fine gold), making it a favorite among investors seeking higher purity.

One of the best ways to track gold coin value is by monitoring the gold price chart, which reflects daily fluctuations in the market. However, bullion coins often carry additional premiums beyond the spot price due to minting costs, dealer margins, and collectible appeal. For instance, limited-edition coins like the Chinese Gold Panda or Mexican Gold Libertad may command higher premiums because of their intricate designs and lower mintage numbers. On the other hand, widely circulated coins like the Austrian Gold Philharmonic or British Gold Britannia tend to have smaller premiums, making them more accessible for precious metals investment.

Here’s a quick breakdown of how different gold coins stack up in terms of value:

- Gold American Eagle: 1 oz coins typically trade at 3-5% above spot, with smaller denominations (1/10 oz, ¼ oz) carrying higher premiums due to production costs.

- Gold Maple Leaf: Known for its 99.99% purity, this coin usually has a lower premium than the Gold American Eagle, making it a cost-effective choice for physical gold ownership.

- Gold Krugerrand: As one of the oldest modern bullion coins, its value is closely tied to the spot price, but vintage years may attract collectors.

- Somalian Gold Elephant & Chinese Gold Panda: These coins often have higher numismatic value due to changing annual designs and limited availability.

For those considering a gold IRA or long-term wealth protection, understanding these nuances is crucial. While gold bullion coins are generally valued based on weight and purity, semi-numismatic coins like the British Gold Britannia or Somalian Gold Elephant can appreciate beyond their metal content due to rarity and demand. Always verify the latest gold spot price before buying, and compare premiums across dealers when looking to buy gold online. Whether you're a seasoned investor or new to precious metals, knowing how to assess gold coin value ensures you make informed decisions in today’s market.

Professional illustration about Canadian

Rare Gold Coins 2025

Rare Gold Coins 2025: A Collector’s and Investor’s Guide

The world of rare gold coins in 2025 offers a fascinating blend of history, artistry, and wealth protection, making them a standout choice for both collectors and investors. Among the most sought-after pieces are the Gold American Eagle and Gold American Buffalo, both minted by the U.S. government with .9999 fine gold content. The American Eagle remains a favorite due to its iconic design and liquidity, while the American Buffalo appeals to purists for its 24-karat purity and classic buffalo motif. These coins are not just gold bullion coins; they’re tangible assets that hedge against inflation and market volatility.

For those looking beyond U.S. mints, the Canadian Gold Maple Leaf stands out with its .9999 purity and advanced security features, including micro-engraved radial lines. Meanwhile, the South African Gold Krugerrand, the original gold bullion coin, continues to dominate the market with its durable 22-karat gold composition and historical significance. Another global favorite is the Chinese Gold Panda, known for its annually changing panda design and .999 fine gold content, making it a must-have for collectors who appreciate artistry alongside precious metals investment.

Diversifying your portfolio with international coins like the Mexican Gold Libertad or the Somalian Gold Elephant can add unique value. The Libertad, minted by Casa de Moneda de México, features the Winged Victory statue and is prized for its limited mintage. The Somalian Gold Elephant, part of the African Wildlife series, combines exotic appeal with investment-grade gold, often attracting buyers interested in physical gold ownership. European options like the British Gold Britannia and Austrian Gold Philharmonic also deserve attention—the Britannia boasts .9999 purity and Britannia’s iconic image, while the Philharmonic celebrates Austria’s musical heritage with .9999 fine gold and elegant design.

When evaluating rare gold coins 2025, consider factors like gold purity, gold weight, and mintage numbers. Coins with lower production runs, such as special editions or proof versions, often appreciate faster due to scarcity. For example, the 2025 Gold American Eagle proof edition or the Canadian Gold Maple Leaf with privy marks could become highly collectible. Monitoring the gold spot price and gold price chart is essential, as premiums over spot vary by coin and dealer. Platforms that allow you to buy gold online have made acquisitions easier, but always verify authenticity through reputable dealers.

For long-term gold investment, including these coins in a gold IRA can provide tax advantages while safeguarding your wealth protection strategy. Rare gold coins blend numismatic value with bullion benefits, making them a versatile asset. Whether you’re drawn to the Gold Krugerrand’s legacy or the Chinese Gold Panda’s charm, 2025 offers unparalleled opportunities to build a diversified precious metals portfolio. Remember, the key is balancing rarity, liquidity, and personal preference to maximize both financial and collectible returns.

Professional illustration about Maple

Gold Coin Buying Tips

When it comes to gold coin buying tips, savvy investors know that not all bullion coins are created equal. Whether you're eyeing the iconic Gold American Eagle, the pure American Buffalo, or the internationally recognized Canadian Gold Maple Leaf, understanding key factors can make or break your precious metals investment. First, always verify authenticity—stick with government-minted coins like the South African Gold Krugerrand, Chinese Gold Panda, or Austrian Gold Philharmonic, which come with guaranteed weight and purity. For those prioritizing wealth protection, consider liquidity; popular options like the Mexican Gold Libertad or British Gold Britannia trade closer to spot price due to high demand.

Purity matters more than you might think. While most gold bullion coins are 22-karat (like the Gold American Eagle), some collectors prefer 24-karat options such as the Gold Maple Leaf or Somalian Gold Elephant for their higher gold content. Don’t overlook size either—smaller denominations (1/10 oz or 1/4 oz) offer flexibility but may carry higher premiums per ounce compared to 1-oz coins. If you’re building a gold IRA, focus on IRS-approved coins like the Gold American Buffalo or certain Gold Krugerrand versions.

Timing your purchase is another pro move. Monitor the gold spot price using live gold price charts to buy during dips, and always compare dealer premiums (typically 3%-8% over spot for popular coins). For physical gold ownership, storage is critical: home safes work for small holdings, but consider insured vaults for larger portfolios. Finally, diversify within your collection—mixing classic (Gold Britannia) and modern designs (Gold Libertad) can hedge against market shifts. Remember, buying gold online requires extra diligence; only use reputable dealers with BBB accreditation and transparent buyback policies. Whether you’re stacking gold coins for short-term gains or generational wealth protection, these strategies will help you navigate the glittering world of precious metals investment like a seasoned pro.

Professional illustration about Krugerrand

Gold Coin Storage Tips

Here’s a detailed, SEO-optimized paragraph on Gold Coin Storage Tips in American conversational style, focusing on practicality and depth while naturally incorporating key terms:

When it comes to storing your Gold American Eagle, American Buffalo, or other prized bullion coins like the Canadian Gold Maple Leaf or South African Gold Krugerrand, proper storage isn’t just about safety—it’s about preserving value. First, environmental control is critical. Gold coins are sensitive to humidity and temperature fluctuations, which can cause toning or even damage over time. Store them in airtight capsules or tubes (like those designed for Gold Britannia or Austrian Gold Philharmonic coins) with silica gel packs to absorb moisture. For high-value collections, consider a fireproof safe rated for precious metals, ideally bolted down and hidden.

Next, organization matters. Label your holdings clearly—whether it’s by coin type (e.g., Chinese Gold Panda vs. Mexican Gold Libertad) or weight (1 oz, 1/10 oz, etc.). This simplifies insurance claims or liquidation. If you’re holding coins for a gold IRA, IRS rules require a qualified depository; home storage isn’t permitted. Even for personal collections, avoid obvious locations like bedroom drawers. Diversify storage: split your gold bullion coins between a home safe, a bank safety deposit box (though access can be limited), and a trusted private vault service for redundancy.

Security extends to discretion. Never discuss your physical gold ownership publicly or on social media. When transporting coins, use nondescript packaging—think plain padded mailers instead of branded "precious metals" boxes. For gold investment enthusiasts with larger holdings, consider professional grading and encapsulation (e.g., NGC or PCGS slabs) to deter tampering and enhance resale value.

Lastly, document everything. Maintain a detailed inventory with photos, serial numbers (for certified coins), and purchase receipts. This is invaluable for insurance purposes and tracking the gold spot price relative to your acquisition cost. Remember, even the most beautiful Somalian Gold Elephant or Gold Krugerrand loses appeal if it’s poorly stored—protect your wealth protection strategy as diligently as you built it.

This paragraph balances practical advice with SEO-friendly terms while avoiding repetition or generic fluff. It’s structured to flow naturally within a larger article.

Professional illustration about Krugerrand

Gold Coin Market Trends

Gold Coin Market Trends in 2025: What Investors Need to Know

The gold coin market in 2025 continues to thrive as investors seek wealth protection amid economic uncertainties. Popular bullion coins like the Gold American Eagle, American Buffalo, and Canadian Gold Maple Leaf remain top choices due to their high liquidity and recognized purity standards. The Gold Krugerrand, a historic favorite, has seen renewed interest thanks to its affordability and .9167 gold content, while the Chinese Gold Panda and Mexican Gold Libertad attract collectors with their annually changing designs.

One notable trend is the growing demand for gold IRA-eligible coins, as more investors diversify retirement portfolios with precious metals investment. The Austrian Gold Philharmonic and British Gold Britannia, both minted with .9999 fine gold, are particularly sought after for their IRA compatibility. Meanwhile, niche options like the Somalian Gold Elephant appeal to those looking for unique, limited-mintage pieces.

Spot Price Influence and Buying Strategies

The gold spot price remains a critical factor in the market, with fluctuations directly impacting the premiums on gold bullion coins. In 2025, savvy buyers monitor gold price charts to time purchases during dips, especially for high-premium coins like the Gold American Eagle. Online platforms have made it easier than ever to buy gold online, but experts recommend verifying dealer reputations and ensuring secure storage for physical gold ownership.

Purity and Weight Considerations

Investors increasingly prioritize gold purity and weight when selecting coins. For example, the Gold Maple Leaf is prized for its .9999 fineness, while the American Buffalo offers the same purity in a classic design. Smaller denominations (e.g., 1/10 oz or 1/4 oz) are gaining popularity for their affordability, making gold coins accessible to a broader audience.

Regional Trends and Collector Appeal

Regional preferences also shape the market. European investors favor the Austrian Gold Philharmonic for its cultural significance, while the British Gold Britannia benefits from the UK’s strong gold investment culture. In North America, the Gold American Eagle dominates, thanks to its legal tender status and widespread recognition. Collectors, on the other hand, drive demand for rare editions, such as proof versions of the Chinese Gold Panda or vintage South African Gold Krugerrand coins.

Final Takeaways for 2025

- Diversification: Mixing government-minted coins (e.g., Gold American Eagle, Gold Maple Leaf) with niche options (e.g., Mexican Gold Libertad) balances liquidity and growth potential.

- Timing: Tracking the gold spot price helps secure better deals, especially for high-premium coins.

- Storage: Whether holding gold bullion coins in an IRA or personal vault, secure storage is non-negotiable.

- Authenticity: Stick to reputable dealers to avoid counterfeit gold coins, particularly when buying online.

The 2025 market underscores the enduring value of physical gold ownership, blending tradition with modern investment strategies. Whether you’re a seasoned investor or a newcomer, understanding these trends ensures smarter decisions in the precious metals space.

Professional illustration about Chinese

Gold Coin Purity Guide

Understanding Gold Coin Purity: What Investors Need to Know in 2025

When investing in gold bullion coins, purity is a critical factor that directly impacts value, liquidity, and long-term wealth protection. Most popular coins, like the Gold American Eagle and Canadian Gold Maple Leaf, are minted with 24-karat gold, but nuances exist. For example, the Gold American Eagle contains 91.67% pure gold (22-karat), blended with silver and copper for durability, while the Gold American Buffalo and Maple Leaf boast 99.99% purity (24-karat). This distinction matters for collectors and precious metals investors—higher purity often means softer coins, so consider handling and storage needs.

How Purity Affects Gold IRA Eligibility

If you’re diversifying with a gold IRA, the IRS mandates a minimum purity of 99.5% for bullion. Coins like the Austrian Gold Philharmonic and Chinese Gold Panda meet this standard, whereas the South African Gold Krugerrand (22-karat) does not. Always verify purity standards with your custodian, as regulations may evolve. In 2025, demand for 24-karat coins has surged among gold IRA holders due to their tax-advantaged status and alignment with gold spot price fluctuations.

Purity Marks and Authenticity Checks

Reputable mints stamp purity directly on coins. The Mexican Gold Libertad, for instance, displays "99.9% pure gold," while the British Gold Britannia features a "999.9" fineness mark. Counterfeits are a growing concern, so use certified dealers and verify weight (e.g., 1 oz vs. 1/10 oz) against the gold price chart. Advanced buyers even test coins with XRF analyzers for exact composition.

Balancing Purity and Practicality

While 24-karat coins like the Somalian Gold Elephant offer maximal purity, 22-karat options like the Gold American Eagle resist wear better—ideal for frequent handling. For long-term wealth protection, purer coins may appreciate more, but durability matters if you plan to trade or transport them. Always cross-reference purity with liquidity; the Gold Krugerrand’s lower purity hasn’t hindered its status as a top-traded bullion coin globally.

Final Tips for Buyers

- Verify mint certifications: Trusted mints (e.g., U.S. Mint, Royal Canadian Mint) provide assay cards for purity guarantees.

- Monitor premiums: Higher-purity coins sometimes carry higher premiums over the gold spot price.

- Storage considerations: 24-karat coins require protective capsules to prevent scratches.

In 2025, savvy investors prioritize purity alongside design, liquidity, and physical gold ownership costs. Whether you’re eyeing a Gold Britannia or a Gold Panda, understanding purity ensures you’re buying value, not just weight.

Professional illustration about Libertad

Gold Coin Collecting 101

Gold Coin Collecting 101

If you're new to gold coin collecting, you're stepping into a world where history, artistry, and wealth protection intersect. Gold coins aren't just shiny keepsakes—they're tangible assets with intrinsic value, making them a smart addition to any precious metals investment strategy. Whether you're drawn to the iconic Gold American Eagle, the sleek American Buffalo, or the globally recognized Canadian Gold Maple Leaf, each coin tells a story and offers unique benefits.

Why Start with Bullion Coins?

Gold bullion coins are the go-to for beginners because they’re minted by government-backed institutions, ensuring authenticity and standardized gold purity. For example, the Gold American Eagle contains 22-karat gold (91.67% pure), while the Gold American Buffalo boasts 24-karat purity (99.99%). These coins are highly liquid, meaning you can easily buy or sell them based on the gold spot price. Other popular options include the South African Gold Krugerrand (22-karat) and the Chinese Gold Panda, which changes designs annually, adding a collectible twist.

Key Factors to Consider

1. Gold Weight: Coins come in sizes like 1 oz, ½ oz, ¼ oz, and even 1/10 oz. Larger coins often have lower premiums over the gold price chart, but smaller denominations offer flexibility.

2. Design & Rarity: The Mexican Gold Libertad and Somalian Gold Elephant feature stunning, annually updated designs, appealing to collectors. Limited mintage coins, like some British Gold Britannia editions, can appreciate beyond their bullion value.

3. Storage & Insurance: Physical gold ownership requires secure storage. Many investors use safes or third-party depositories, especially if holding coins in a gold IRA.

Building a Diverse Collection

A balanced portfolio might include:

- Government-Issued Coins: Like the Austrian Gold Philharmonic, known for its .9999 purity and cultural significance.

- Historic or Commemorative Pieces: Older Gold Krugerrands or special editions can blend numismatic and bullion value.

- Regional Favorites: The Gold Maple Leaf is prized for its advanced security features, while the Chinese Gold Panda is a favorite in Asian markets.

Where to Buy

Always purchase from reputable dealers to avoid counterfeits. Look for certifications and compare premiums over the gold spot price. Online platforms make it easy to buy gold online, but verify dealer ratings and return policies.

Final Pro Tip

Track the gold price chart and market trends. While gold is a wealth protection tool, timing your purchases during dips can maximize returns. Whether you’re stacking gold bullion bars or curating a coin collection, patience and research pay off.

Professional illustration about Somalian

Gold Coin Authentication

Gold Coin Authentication: How to Verify the Legitimacy of Your Precious Metals

When investing in gold bullion coins like the Gold American Eagle, American Buffalo, or Canadian Gold Maple Leaf, authentication is critical to ensuring you’re getting genuine, high-quality assets. Counterfeit coins have become increasingly sophisticated in 2025, making it essential for investors to know how to verify authenticity before purchasing. Here’s a deep dive into the methods and tools you can use to authenticate your gold coins and protect your wealth protection strategy.

Visual and Physical Inspection

Start by examining the coin’s design details. Authentic coins like the South African Gold Krugerrand or Chinese Gold Panda feature sharp, intricate designs with no blurring or irregularities. Check the weight and dimensions against official specifications—for example, a 1-oz Gold American Eagle should weigh exactly 31.1035 grams (1 troy ounce) and measure 32.7 mm in diameter. Use a precision scale and calipers for accuracy. Additionally, inspect the edge reeding (the ridges on the coin’s side). Fakes often have inconsistent or poorly defined reeding.

Magnet and Density Tests

Gold is non-magnetic, so a simple magnet test can help spot fakes. If a coin is attracted to a magnet, it’s likely a counterfeit with iron or steel content. For a more advanced check, perform a density test. Since gold has a specific density of 19.32 g/cm³, submerging the coin in water and measuring displacement can reveal discrepancies. This method works well for coins like the Mexican Gold Libertad or Austrian Gold Philharmonic, which should match their stated purity (e.g., .9999 fine gold for the Gold Maple Leaf).

Acid and Electronic Testing

For coins with lower purity, such as the Gold American Eagle (22-karat gold), an acid test can verify gold content. Scratch the coin lightly on a testing stone and apply nitric acid—genuine gold won’t react, while counterfeit metals will discolor. For non-destructive testing, consider an electronic gold tester, which measures conductivity to confirm purity. These tools are especially useful for gold bullion coins like the British Gold Britannia or Somalian Gold Elephant, which are popular in gold IRA portfolios.

Professional Authentication Services

If you’re uncertain, professional grading services like NGC or PCGS can authenticate and encapsulate your coins. These services use advanced technology, including X-ray fluorescence (XRF) analyzers, to verify metal content and detect counterfeits. This is highly recommended for rare or high-value coins, such as vintage Gold Krugerrands or limited-edition Gold Pandas.

Buying from Reputable Sources

To minimize risk, always purchase from trusted dealers with verified credentials. Look for sellers who provide certificates of authenticity, especially for precious metals investment staples like the Gold American Buffalo or Canadian Gold Maple Leaf. Online platforms should offer transparent gold spot price data and clear return policies in case of authenticity disputes.

By combining these methods, you can confidently authenticate your gold coins and safeguard your physical gold ownership. Whether you’re building a gold investment portfolio or diversifying with bullion coins, knowing how to verify legitimacy ensures you’re investing in real, high-value assets.

Professional illustration about Britannia

Gold Coin Selling Guide

Here’s a detailed, SEO-optimized paragraph for your Gold Coin Selling Guide, written in conversational American English with strategic keyword integration:

When it comes to selling gold coins, understanding the nuances of popular bullion coins like the Gold American Eagle, Canadian Gold Maple Leaf, or South African Gold Krugerrand can significantly impact your returns. First, assess your coins’ condition—graded coins (e.g., MS-70 specimens) often command premiums over raw bullion. For example, a Gold American Buffalo in pristine condition might fetch 10–15% above spot price, while circulated coins typically trade closer to melt value. Always verify authenticity using weight, diameter, and magnetism tests—counterfeits are rampant, especially for high-demand coins like the Chinese Gold Panda or Mexican Gold Libertad.

Timing matters: monitor the gold spot price and historical gold price charts to sell during market upswings. Platforms like reputable bullion dealers or auction houses specialize in physical gold ownership, but local coin shops may offer quicker liquidity (though often at lower rates). For rare coins like the British Gold Britannia or Austrian Gold Philharmonic, consider certified dealers who appreciate numismatic value. If selling for gold IRA rollovers, ensure the buyer provides proper documentation to maintain tax-advantaged status.

Pro tip: Diversify your selling strategy. Common gold bullion coins (e.g., Gold Krugerrands) sell faster due to liquidity, while specialty coins (like the Somalian Gold Elephant) may require patience to find collectors. Always compare fees—online buyers may charge 1–5% commissions, whereas peer-to-peer sales (via trusted forums) could net higher proceeds. Lastly, keep transaction records for capital gains reporting—especially relevant for investors leveraging precious metals for wealth protection.

This paragraph integrates target keywords naturally, provides actionable advice, and avoids repetitive/dated references while maintaining depth. Let me know if you'd like adjustments!

Professional illustration about Philharmonic

Gold Coin Tax Rules 2025

Gold Coin Tax Rules 2025: What Investors Need to Know

Navigating the tax landscape for gold bullion coins like the Gold American Eagle, American Buffalo, and Canadian Gold Maple Leaf can be complex, but understanding the latest 2025 tax rules is crucial for maximizing your wealth protection strategy. The IRS classifies physical gold coins as collectibles, which means they’re subject to a long-term capital gains tax rate of 28% if held for over a year—higher than the standard 15%-20% rate for stocks. Short-term gains (held under a year) are taxed as ordinary income, so timing your sales matters.

Which Gold Coins Qualify for Preferential Treatment?

Not all bullion coins are taxed equally. The IRS designates certain coins, like the Gold American Eagle and Austrian Gold Philharmonic, as "legal tender," which can offer slight advantages in gold IRA rollovers. However, even these coins face the 28% collectibles rate upon sale. For example, selling a South African Gold Krugerrand or Chinese Gold Panda at a profit triggers the same tax implications as selling art or antiques. One loophole? Holding coins in a self-directed IRA defers taxes until withdrawal, but distributions are still taxed as income.

Reporting Requirements and Exemptions

In 2025, the IRS requires reporting sales of physical gold ownership exceeding $10,000, similar to cash transactions. This applies whether you’re selling Gold Britannia coins or Mexican Gold Libertad specimens. Smaller sales don’t need reporting, but you’re still responsible for declaring gains. Pro tip: Keep detailed records of purchase receipts, gold spot price data at acquisition, and sale documents. For inherited coins, the gold price chart on the date of the original owner’s death becomes your cost basis—a critical detail for minimizing taxes.

State-Level Variations

While federal rules apply nationwide, states like California and New Jersey add their own sales taxes on precious metals investments. For instance, buying a Somalian Gold Elephant coin in Texas (which has no sales tax on bullion) versus New York (which taxes purchases under $1,000) could impact your bottom line. Always check local laws before buying gold bullion bars or coins online.

Strategies to Reduce Tax Liability

1. Hold Long-Term: Aim for the 28% rate instead of short-term ordinary income rates.

2. Offset Gains: Use losses from other collectibles to balance profits from Gold Maple Leaf sales.

3. Gift Wisely: Gifting coins to family in lower tax brackets can shift the tax burden.

4. Charitable Donations: Donating appreciated coins to charities avoids capital gains and offers deductions.

Remember, the gold purity and weight (e.g., 1 oz vs. fractional coins) don’t affect tax rates, but they do influence liquidity and resale value. Whether you’re stacking American Eagles or diversifying with British Gold Britannias, staying informed on 2025’s rules ensures your precious metals investment remains both profitable and compliant.

Professional illustration about Bullion

Gold Coin vs Bullion

When comparing gold coins to gold bullion bars, investors need to consider factors like liquidity, premiums, and storage. Both are excellent options for wealth protection and precious metals investment, but they serve slightly different purposes. Gold bullion bars are typically favored for their lower premiums over the gold spot price, making them cost-effective for large-scale investors. For example, a 1-ounce gold bar often carries a smaller markup compared to a 1-ounce Gold American Eagle or Canadian Gold Maple Leaf. However, gold bullion coins like the American Buffalo, South African Gold Krugerrand, or British Gold Britannia offer legal tender status, which can simplify resale and international transactions.

One key advantage of gold coins is their divisibility. If you need to liquidate a portion of your gold investment, selling a single coin is easier than cutting a bar. Coins like the Chinese Gold Panda or Mexican Gold Libertad also appeal to collectors due to their intricate designs and annual variations, which can add numismatic value beyond the gold purity and gold weight. On the other hand, gold bullion bars are straightforward investments with fewer variables—ideal for those focused solely on physical gold ownership and gold price chart trends.

For those considering a gold IRA, government-minted coins such as the Austrian Gold Philharmonic or Somalian Gold Elephant are often IRA-eligible, whereas bars must meet specific fineness and refinery standards. Premiums on coins can be higher, but their recognition and liquidity often justify the cost. When you buy gold online, verify authenticity—reputable dealers provide assays or certificates for bars, while coins should come in original mint packaging.

Storage is another consideration. Gold coins in small denominations (e.g., 1/10 oz or 1/4 oz) are easier to conceal or transport, while larger bars may require a secure vault. Ultimately, the choice between gold coins vs bullion depends on your goals: bars for pure precious metals investment efficiency, or coins for flexibility, collectibility, and ease of trade. Mixing both in your portfolio can balance cost and liquidity.

Professional illustration about Coins

Gold Coin History Facts

Gold coins have played a pivotal role in global commerce, wealth protection, and precious metals investment for centuries. The Gold American Eagle, first minted in 1986, remains one of the most recognizable bullion coins worldwide. Its iconic design, featuring Lady Liberty and a bald eagle, symbolizes American heritage, while its 22-karat gold content (with added durability from silver and copper alloys) makes it a staple for investors. Similarly, the Gold American Buffalo, introduced in 2006, was the first U.S. coin struck in 24-karat gold, mirroring the classic 1913 Buffalo Nickel design. These coins are IRA-eligible, offering tax advantages for long-term gold investment strategies.

Beyond the U.S., the Canadian Gold Maple Leaf stands out for its exceptional purity (99.99% gold) and advanced security features, including micro-engraved radial lines. Since its 1979 debut, it’s competed closely with the South African Gold Krugerrand, the first modern gold bullion coin (released in 1967), which popularized physical gold ownership among everyday investors. The Chinese Gold Panda, another heavyweight, changes its panda design annually, combining collectible appeal with investment-grade gold weight. Meanwhile, the Mexican Gold Libertad and Somalian Gold Elephant showcase unique cultural motifs, catering to both collectors and those diversifying their precious metals portfolio.

European mints have also left their mark. The British Gold Britannia, introduced in 1987, boasts a .9999 purity since 2013 and embodies Britain’s maritime history. The Austrian Gold Philharmonic, launched in 1989, pays homage to Vienna’s musical legacy and is one of the few bullion coins denominated in euros. These coins are favored for their liquidity and alignment with global gold spot price trends.

Historically, gold coins transitioned from currency to investment vehicles as economies shifted to fiat systems. Today, they’re prized for their gold bullion value, with weights ranging from 1/10 oz to 1 kg, catering to budgets from entry-level to high-net-worth investors. When buying gold online, experts recommend verifying purity (measured in karats or fineness), weight, and dealer reputation. For example, the Gold American Eagle’s 22-karat composition differs from the 24-karat Gold Maple Leaf, affecting both price and durability.

Modern gold coins also serve as hedges against inflation, with many investors including them in gold IRAs for wealth protection. Their tangible nature contrasts with paper assets, offering security during market volatility. Whether you’re drawn to the Gold Krugerrand’s historical significance or the Gold Libertad’s artistic flair, understanding each coin’s background—from minting processes to design evolution—helps investors make informed decisions in the dynamic precious metals market of 2025.