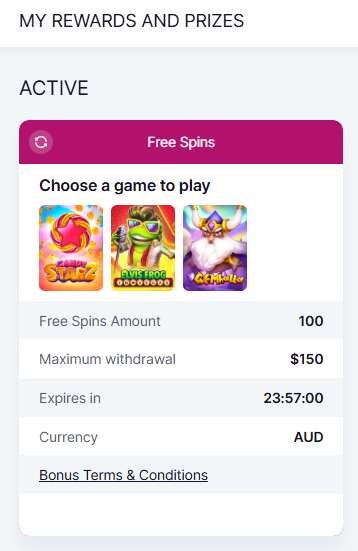

Professional illustration about Bitcoin

Bitcoin Basics 2025

Bitcoin Basics 2025

In 2025, Bitcoin (BTC) remains the undisputed leader in the cryptocurrency space, with a market capitalization that dwarfs competitors like Bitcoin Cash. As the original peer-to-peer network envisioned by Satoshi Nakamoto, Bitcoin continues to function as digital gold—a store of value and hedge against inflation, especially amid global economic uncertainty. The proof-of-work consensus mechanism, though energy-intensive, ensures security and decentralization, making it resistant to censorship. Companies like MicroStrategy and BlackRock have doubled down on BTC, treating it as a core part of their treasury strategies, while nations like El Salvador still recognize it as legal tender, alongside the US dollar.

The Lightning Network has matured significantly, enabling faster and cheaper peer-to-peer transactions, which is critical for everyday use. Platforms like Binance and Coinbase dominate cryptocurrency exchange activity, offering seamless trading with high trading volume, though volatility remains a factor for traders relying on technical analysis. Meanwhile, mining has evolved with more sustainable energy solutions, addressing environmental concerns without compromising the network’s integrity.

Decentralized finance (DeFi) applications increasingly integrate Bitcoin, bridging the gap between its proof-of-work foundation and smart contracts functionality. While Bitcoin itself doesn’t natively support complex smart contracts, layer-2 solutions and partnerships with other blockchains expand its utility. Visionaries like Arthur Hayes predict Bitcoin will further solidify its role in global finance, especially as institutional adoption grows.

One of the most ambitious projects tied to Bitcoin is Bitcoin City, a proposed hub in El Salvador powered by geothermal energy from volcanoes—a nod to both innovation and sustainability. Whether you’re a long-term holder, trader, or just curious about blockchain technology, understanding Bitcoin’s fundamentals is essential in 2025, as its influence extends beyond cryptocurrency into mainstream finance and technology.

Professional illustration about MicroStrategy

Crypto Investing Tips

Crypto Investing Tips for 2025: How to Navigate the Bitcoin Boom

If you're diving into cryptocurrency investing this year, Bitcoin (BTC) remains the cornerstone of any solid portfolio. With institutional giants like BlackRock and MicroStrategy doubling down on BTC, its role as digital gold and a store of value is stronger than ever. But how do you invest wisely in a market known for its volatility? Here’s what you need to know.

First, dollar-cost averaging (DCA) is your best friend. Instead of timing the market—a near-impossible feat—consistently buying small amounts of BTC over time (say, weekly or monthly) smooths out price swings. Platforms like Coinbase and Binance make this easy with automated recurring purchases. For example, if you’d DCA’d into Bitcoin during its 2022 dip, you’d be sitting on massive gains by 2025.

Next, understand the proof-of-work mechanism behind Bitcoin. Unlike Bitcoin Cash or newer smart contract platforms, BTC’s mining process ensures security through computational power. This makes it resistant to attacks but also energy-intensive. Keep an eye on innovations like the Lightning Network, which speeds up peer-to-peer transactions while reducing fees—key for real-world adoption, as seen in El Salvador, where BTC is legal tender.

Diversification matters, but don’t overdo it. While altcoins can offer explosive growth, Bitcoin’s market capitalization and liquidity make it the safest bet. Institutional interest, like BlackRock’s spot BTC ETF, signals long-term confidence. That said, allocate a small portion of your portfolio to high-potential projects in decentralized finance (DeFi) or layer-2 solutions tied to Bitcoin’s ecosystem.

Technical analysis can help, but don’t rely on it blindly. Study historical patterns, support/resistance levels, and trading volume trends, but pair this with macro trends. For instance, Arthur Hayes, former CEO of BitMEX, often highlights how global liquidity cycles impact BTC’s price. In 2025, factors like Fed policy shifts or adoption in projects like Bitcoin City could be major catalysts.

Finally, security is non-negotiable. Use hardware wallets for large holdings and enable two-factor authentication on exchanges. Remember, Satoshi Nakamoto designed Bitcoin as a peer-to-peer network—you’re your own bank. Whether you’re a rookie or a seasoned investor, these strategies will help you navigate the crypto waves with confidence.

Professional illustration about BTC

Blockchain Explained

Blockchain Explained: The Backbone of Bitcoin and Beyond

At its core, a blockchain is a decentralized, immutable ledger that records transactions across a peer-to-peer network. It’s the technology powering Bitcoin (BTC) and thousands of other cryptocurrencies, but its applications stretch far beyond digital money. Think of it as a digital spreadsheet duplicated across thousands of computers (nodes), where every transaction is transparent, tamper-proof, and verified by consensus. Unlike traditional banking systems controlled by central authorities, blockchain operates without intermediaries—whether you’re sending BTC on Coinbase, trading on Binance, or using the Lightning Network for instant micropayments.

How Blockchain Works: From Mining to Smart Contracts

The Bitcoin blockchain relies on proof-of-work (PoW), a consensus mechanism where mining rigs solve complex mathematical puzzles to validate transactions and add new blocks. This process secures the network and rewards miners with newly minted BTC—a system envisioned by the mysterious Satoshi Nakamoto. However, blockchain isn’t just about peer-to-peer transactions. Platforms like Ethereum expanded its utility with smart contracts, self-executing agreements that automate processes in decentralized finance (DeFi). Meanwhile, companies like MicroStrategy and asset managers like BlackRock treat Bitcoin as digital gold, a store of value backed by blockchain’s transparency and scarcity (only 21 million BTC will ever exist).

Real-World Adoption: From El Salvador to Bitcoin City

Blockchain’s impact is undeniable. In 2025, El Salvador remains the only country where Bitcoin is legal tender, thanks to its blockchain infrastructure. Projects like Bitcoin City—a proposed tax-free crypto hub—highlight ambitions to integrate blockchain into urban economies. Even Bitcoin Cash, a fork of Bitcoin, leverages blockchain for faster, low-fee payments. Yet challenges persist: volatility, regulatory scrutiny (as seen with Binance and Coinbase), and debates over proof-of-work’s energy use. For traders, understanding technical analysis and market capitalization trends is crucial, as blockchain’s transparency allows real-time tracking of trading volume and network activity.

Why Blockchain Matters Beyond Cryptocurrency

While Arthur Hayes and other crypto pioneers focus on financial disruption, blockchain’s potential spans supply chains, voting systems, and even identity verification. Its decentralized nature reduces fraud, and its open-source ethos invites innovation—whether you’re a developer, investor, or just curious about the future of money. The key takeaway? Blockchain isn’t just the engine behind BTC; it’s a paradigm shift in how we trust and transfer value globally.

Professional illustration about Binance

Bitcoin Price Trends

Bitcoin Price Trends in 2025: What You Need to Know

Bitcoin (BTC) continues to dominate the cryptocurrency market, with its price trends reflecting a mix of institutional adoption, macroeconomic factors, and technological advancements. In 2025, BTC remains highly volatile, yet its long-term trajectory leans bullish due to growing acceptance as digital gold and legal tender in countries like El Salvador. Major players like MicroStrategy and BlackRock have doubled down on Bitcoin, treating it as a store of value amid inflationary pressures. Meanwhile, exchanges like Binance and Coinbase report record trading volumes, signaling sustained retail and institutional interest.

One key driver of Bitcoin’s price is its proof-of-work mining mechanism, which ensures security but also faces scrutiny over energy consumption. Innovations like the Lightning Network are addressing scalability, enabling faster peer-to-peer transactions and reducing fees—critical for mainstream adoption. Technical analysts closely monitor BTC’s market capitalization and trading volume to predict trends, often using tools like moving averages and support/resistance levels. For example, when Bitcoin broke past its all-time high in early 2025, it triggered a wave of FOMO (fear of missing out) among investors, further fueling the rally.

However, Bitcoin’s price isn’t immune to external shocks. Regulatory developments, such as the SEC’s stance on Bitcoin ETFs, or macroeconomic shifts like interest rate changes, can cause sharp fluctuations. Arthur Hayes, former CEO of BitMEX, has often highlighted Bitcoin’s correlation with global liquidity cycles, arguing that BTC thrives in environments with loose monetary policy. Meanwhile, competitors like Bitcoin Cash (a fork of BTC) and emerging decentralized finance (DeFi) projects add layers of complexity to Bitcoin’s dominance.

For traders and long-term holders alike, understanding Bitcoin’s volatility is crucial. Here are some actionable insights:

- Dollar-cost averaging (DCA): Spreading purchases over time mitigates risk during price swings.

- Monitoring on-chain metrics: Metrics like the SOPR (Spent Output Profit Ratio) help gauge market sentiment.

- Keeping an eye on institutional activity: Large buys by firms like MicroStrategy often precede upward momentum.

The concept of Bitcoin City, a proposed crypto hub in El Salvador, also hints at Bitcoin’s expanding real-world utility. As the peer-to-peer network grows stronger and more enterprises integrate BTC payments, its price could see further stabilization. Yet, the shadow of Satoshi Nakamoto’s anonymous legacy looms large—any sudden movement of early mined coins could send shockwaves through the market. Whether you’re a day trader or a HODLer, staying informed about these dynamics is key to navigating Bitcoin’s unpredictable yet rewarding landscape.

Professional illustration about BlackRock

Secure Wallet Guide

Choosing the Right Bitcoin Wallet for Maximum Security

With Bitcoin's market capitalization surpassing $1.5 trillion in 2025, securing your BTC has never been more critical. Whether you're a long-term holder like MicroStrategy or an active trader on platforms like Binance and Coinbase, your wallet choice directly impacts your crypto safety. Let’s break down the best practices for securing your Bitcoin, from hardware wallets to decentralized finance (DeFi) integrations.

Hardware Wallets: The Gold Standard

For those treating Bitcoin as digital gold, hardware wallets like Ledger or Trezor offer offline storage, isolating your private keys from internet-connected devices. These wallets use proof-of-work principles to generate secure keys, making them immune to remote hacks. For example, BlackRock’s institutional clients often opt for multisig hardware solutions, combining biometric authentication with encrypted backups. If you’re holding a significant amount of BTC—say, for a project like Bitcoin City in El Salvador—a hardware wallet is non-negotiable.

Software Wallets: Balancing Convenience and Risk

Mobile and desktop wallets like Electrum or Exodus are great for smaller, frequent transactions, especially if you’re using the Lightning Network for peer-to-peer payments. However, they’re vulnerable to malware. Always enable two-factor authentication (2FA) and avoid storing large sums. Arthur Hayes, co-founder of BitMEX, famously emphasized the importance of air-gapped backups for software wallets—a tip that’s still relevant in 2025.

Exchange Wallets: Proceed with Caution

Leaving Bitcoin on exchanges like Binance or Coinbase is convenient for trading, but it’s riskier than self-custody. In 2025, even regulated platforms face threats like API breaches or liquidity crises. If you must use an exchange wallet, diversify across platforms and withdraw to a private wallet after major trades. The collapse of several mid-tier exchanges this year proved that market capitalization doesn’t always equate to security.

Advanced Security Measures

- Multisignature Wallets: Ideal for businesses or groups, requiring multiple approvals for transactions. Companies like MicroStrategy use multisig to protect corporate BTC reserves.

- Seed Phrase Management: Write your 12-24 word recovery phrase on steel plates, not paper, to survive physical damage. Satoshi Nakamoto’s original whitepaper stressed the irreplaceable nature of private keys.

- Decentralized Finance (DeFi) Integrations: If you’re leveraging smart contracts, use wallets with built-in DeFi shields, like MetaMask’s anti-phishing features.

Final Tips for 2025

With volatility and regulatory shifts (like El Salvador’s legal tender status for Bitcoin), staying updated is key. Regularly audit your wallet’s activity, avoid public Wi-Fi for transactions, and consider privacy-focused coins like Bitcoin Cash for smaller, anonymous transfers. Remember: In the peer-to-peer network of blockchain, your security is your responsibility.

Professional illustration about Blockchain

Mining Profitability

Mining Profitability in 2025: What You Need to Know

Bitcoin mining profitability remains a hot topic in 2025, especially as the industry evolves with new technologies, regulatory shifts, and market dynamics. While Bitcoin (BTC) continues to dominate as digital gold, miners face challenges like rising energy costs, halving events, and competition from institutional players like BlackRock and MicroStrategy, who are heavily invested in BTC as a store of value.

- Energy Costs: Mining relies on proof-of-work, which demands significant electricity. Regions with cheap renewable energy (like El Salvador, which adopted BTC as legal tender) are becoming mining hubs. However, volatility in energy prices can drastically impact margins.

- Halving Events: The 2024 halving reduced block rewards to 3.125 BTC, squeezing profits for smaller miners. In 2025, only the most efficient operations—those with advanced ASICs or access to low-cost power—remain competitive.

Institutional Influence: Companies like Coinbase and Binance have expanded into mining services, while BlackRock’s spot BTC ETF has increased demand, indirectly supporting prices. This institutional adoption can stabilize market capitalization, but it also centralizes mining power.

Leverage the Lightning Network: This peer-to-peer layer-2 solution reduces transaction fees, making smaller miners more viable.

- Join Mining Pools: Solo mining is nearly impossible now. Pools like F2Pool or Antpool distribute rewards more evenly, though fees apply.

- Diversify Revenue Streams: Some miners use excess energy for other decentralized finance (DeFi) projects or sell computational power for smart contracts.

With Bitcoin City in El Salvador piloting geothermal-powered mining and innovators like Arthur Hayes advocating for sustainable practices, the industry is shifting toward greener solutions. Meanwhile, proof-of-work purists debate alternatives like Bitcoin Cash’s adjusted difficulty algorithm, though BTC’s trading volume and dominance keep it the top choice for miners.

Technical analysis of hash rate trends and hardware efficiency (like the latest Bitmain S21 Hydro) is crucial for staying profitable. As Satoshi Nakamoto’s vision of a peer-to-peer network evolves, miners must adapt—or risk being left behind.

Professional illustration about Coinbase

DeFi with Bitcoin

DeFi with Bitcoin: The Evolution of Decentralized Finance on the World's First Cryptocurrency

Bitcoin, originally designed as a peer-to-peer electronic cash system, has evolved beyond its store of value narrative to play a surprising role in decentralized finance (DeFi). While Ethereum dominates DeFi with its smart contracts, Bitcoin’s blockchain is now being leveraged for innovative financial applications. The Lightning Network, for instance, enables near-instant, low-cost peer-to-peer transactions, making microtransactions viable—a feature El Salvador capitalized on when adopting BTC as legal tender. Projects like Stacks bring smart contracts to Bitcoin, allowing developers to build DeFi protocols atop its secure proof-of-work foundation.

MicroStrategy and BlackRock’s growing Bitcoin holdings highlight institutional confidence in BTC as digital gold, but the rise of Bitcoin-based DeFi is unlocking new utility. Binance and Coinbase now support wrapped Bitcoin (WBTC), bridging BTC to Ethereum’s DeFi ecosystem. This lets users earn yield through lending platforms or liquidity pools while maintaining exposure to Bitcoin’s price. Meanwhile, Arthur Hayes, former CEO of BitMEX, has championed Bitcoin’s role in DeFi, arguing that its market capitalization and liquidity make it the ideal backbone for decentralized systems.

However, challenges remain. Bitcoin’s volatility can complicate DeFi protocols relying on stable collateral, and its proof-of-work model faces scrutiny over energy use—though proponents argue mining incentivizes renewable energy adoption. The emergence of Bitcoin Cash (a fork emphasizing transactional use) and Bitcoin City (a planned crypto hub in El Salvador) shows competing visions for BTC’s DeFi future. Meanwhile, Satoshi Nakamoto’s original whitepaper foresaw peer-to-peer networks enabling financial autonomy—a vision DeFi is now expanding upon.

For traders, technical analysis of BTC’s price action remains critical, especially as trading volume fluctuates with macroeconomic trends. Yet long-term, Bitcoin’s DeFi integration could redefine its utility beyond speculation, merging its store of value strength with programmable money capabilities. Whether through Lightning Network adoption or cross-chain innovations, Bitcoin’s DeFi journey is just beginning.

Professional illustration about Cryptocurrency

NFTs and Bitcoin

NFTs and Bitcoin: Exploring the Intersection of Digital Assets

While Bitcoin (BTC) is primarily known as digital gold—a store of value and legal tender in countries like El Salvador—its relationship with NFTs (Non-Fungible Tokens) has evolved significantly by 2025. Unlike Ethereum, which dominates the NFT space with its smart contracts, Bitcoin’s blockchain was initially considered ill-suited for NFTs due to its proof-of-work consensus and lack of native smart contract functionality. However, innovations like the Lightning Network and protocols such as Ordinals have unlocked new possibilities, enabling Bitcoin to host NFTs and compete in the decentralized finance (DeFi) arena.

One standout example is MicroStrategy, a publicly traded company that has aggressively accumulated BTC while also exploring NFT integrations. In 2025, MicroStrategy announced a partnership with Coinbase to tokenize real-world assets on the Bitcoin blockchain, blending peer-to-peer transactions with NFT technology. Similarly, Binance and BlackRock have started experimenting with Bitcoin-based NFTs, leveraging the chain’s security and market capitalization to attract institutional investors. These developments highlight Bitcoin’s expanding utility beyond mere cryptocurrency exchange trading.

Critics argue that Bitcoin’s volatility and scalability challenges could hinder NFT adoption. Yet, proponents like Arthur Hayes, former CEO of BitMEX, point to the Lightning Network as a game-changer. By enabling faster, cheaper peer-to-peer network transactions, Bitcoin is becoming more viable for NFT marketplaces. For instance, Bitcoin City, a planned smart city in El Salvador, aims to integrate NFTs for property ownership and civic engagement, further solidifying Bitcoin’s role in digital gold and beyond.

The debate around Bitcoin Cash (a fork of Bitcoin) also intersects with NFTs. While Bitcoin Cash proponents claim its larger block size makes it better suited for NFTs, the majority of developers and investors still favor Bitcoin’s proof-of-work security. Meanwhile, Satoshi Nakamoto’s original vision of a decentralized currency is being tested as NFTs introduce new use cases—from art and gaming to identity verification—on the Bitcoin network.

For traders and creators, understanding technical analysis and trading volume trends is crucial when navigating Bitcoin-based NFTs. Platforms like Coinbase now offer specialized tools for tracking NFT performance alongside traditional cryptocurrency metrics. Whether Bitcoin will dethrone Ethereum as the go-to chain for NFTs remains uncertain, but its growing ecosystem proves that blockchain innovation is far from over.

Professional illustration about Salvador

Tax Rules for Crypto

Understanding Bitcoin and Cryptocurrency Tax Rules in 2025

Navigating the tax implications of Bitcoin and other cryptocurrencies can feel like decoding Satoshi Nakamoto’s whitepaper—complex but crucial. In 2025, the IRS and global tax authorities have tightened regulations, making compliance non-negotiable. Whether you’re trading on Binance or Coinbase, mining BTC, or holding MicroStrategy-sized bags, here’s what you need to know to stay on the right side of the law.

Taxable Events: More Than Just Selling

Every time you swap BTC for Bitcoin Cash, use the Lightning Network for peer-to-peer transactions, or earn interest through decentralized finance (DeFi), the IRS considers it a taxable event. Even staking rewards or smart contracts income must be reported. For example, if you’re part of BlackRock’s crypto ETF or hold El Salvador’slegal tenderBitcoin, you’re not exempt. The key is tracking fair market value at the time of each transaction—tools like Blockchain explorers or portfolio trackers can simplify this.

Capital Gains vs. Income: Know the Difference

Short-term trades (under a year) are taxed as ordinary income, while long-term holdings benefit from lower capital gains rates. Say you bought BTC at $30,000 and sold at $60,000 in 2025 after 18 months—that’s a 15–20% long-term tax on $30,000 profit. But if you’re day-trading with high volatility, expect to pay up to 37% (depending on your bracket). Arthur Hayes, co-founder of BitMEX, often highlights how proof-of-work miners face unique tax burdens, as mined coins are taxed as income upon receipt and as capital gains when sold.

Global Variations: From Bitcoin City to the U.S.

While the U.S. treats crypto as property, El Salvador’sBitcoin City project offers tax-free zones for crypto businesses. Meanwhile, the EU’s Market Capitalization-based rules require reporting for assets over €10,000. If you’re using peer-to-peer networks or cryptocurrency exchanges abroad, research local laws—some countries, like Portugal, still tax-free crypto-to-crypto swaps, while others impose trading volume-based levies.

Pro Tips for Minimizing Liability

- Harvest losses: Offset gains by selling underperforming assets (e.g., Bitcoin Cash during a dip).

- Hold long-term: Aim for the 1-year mark to slash tax rates.

- Use crypto-specific software: Platforms like CoinTracker sync with Coinbase or Binance to auto-calculate gains.

- Don’t forget gifts and donations: Donating BTC to a 501(c)(3) can avoid capital gains and earn a deduction.

The Bigger Picture: Regulation and Reporting

With BlackRock and other institutional players entering the space, 2025 has seen stricter proof of work mining reporting and mandatory technical analysis disclosures for large traders. The SEC even requires cryptocurrency exchanges to issue 1099s for users with $600+ in annual transactions. Bottom line? Treat Bitcoin like digital gold—but with way more paperwork.

Professional illustration about Lightning

Bitcoin ETFs Guide

Bitcoin ETFs Guide

Investing in Bitcoin ETFs has become one of the most accessible ways for mainstream investors to gain exposure to BTC without directly holding the cryptocurrency. Unlike buying Bitcoin on exchanges like Binance or Coinbase, ETFs (Exchange-Traded Funds) allow investors to trade BTC through traditional brokerage accounts, simplifying the process while mitigating risks like self-custody. The approval of BlackRock's spot Bitcoin ETF in early 2024 marked a turning point, legitimizing BTC as a store of value akin to digital gold. These ETFs track the price of Bitcoin by holding the actual asset, unlike futures-based ETFs, which rely on derivatives and often suffer from tracking errors due to volatility.

For investors, Bitcoin ETFs offer several advantages:

- Regulated Exposure: ETFs are regulated by entities like the SEC, providing a layer of security absent in unregulated cryptocurrency exchanges.

- Liquidity: ETFs trade on major stock exchanges, making it easy to buy and sell without dealing with peer-to-peer networks or proof-of-work mining complexities.

- Tax Efficiency: In many jurisdictions, ETFs are treated like stocks, simplifying tax reporting compared to direct peer-to-peer transactions.

However, there are trade-offs. ETF investors don’t own the underlying Bitcoin, meaning they can’t use it for decentralized finance (DeFi) applications or transfer it to private wallets. Additionally, management fees (though often low) eat into returns over time.

MicroStrategy, a corporate BTC heavyweight, has taken a different approach by directly accumulating Bitcoin as a treasury asset—bypassing ETFs altogether. Their strategy highlights an ongoing debate: Is indirect exposure through ETFs sufficient, or should investors hold BTC outright for long-term market capitalization growth?

From a technical standpoint, Bitcoin ETFs rely heavily on blockchain transparency. Providers like BlackRock must prove they hold the actual BTC, often through auditable on-chain reserves. This contrasts with earlier products that faced skepticism over whether they truly backed their holdings—a lesson learned from scandals in the cryptocurrency exchange space.

For traders, technical analysis of Bitcoin ETF performance can mirror traditional stock strategies, though BTC's inherent volatility means higher risk. Meanwhile, countries like El Salvador, which adopted Bitcoin as legal tender, showcase alternative models where ETFs play no role—instead favoring direct integration into national economies.

Looking ahead, innovations like the Lightning Network could influence ETF dynamics by improving Bitcoin's scalability for everyday transactions. Similarly, forks like Bitcoin Cash or experimental projects like Bitcoin City (a proposed blockchain-powered metropolis) remind us that BTC is just one facet of a broader cryptocurrency ecosystem. Whether through ETFs or direct ownership, understanding these nuances is key to navigating Bitcoin's evolving landscape.

Professional illustration about Mining

Crypto Regulations

Crypto Regulations in 2025: What Bitcoin Investors Need to Know

The regulatory landscape for Bitcoin and cryptocurrency has evolved dramatically in 2025, with governments and financial institutions scrambling to keep up with the rapid growth of decentralized finance (DeFi). While El Salvador remains the only country to recognize BTC as legal tender, other nations are taking steps to integrate blockchain technology into their financial systems—albeit with stricter oversight. The U.S. Securities and Exchange Commission (SEC) has intensified its scrutiny of cryptocurrency exchanges like Binance and Coinbase, particularly around proof-of-work (PoW) mining and peer-to-peer transactions. Meanwhile, institutional players like BlackRock and MicroStrategy continue to advocate for clearer guidelines, as their massive BTC holdings hinge on regulatory clarity.

One of the biggest debates centers around whether Bitcoin should be classified as a store of value (akin to digital gold) or a security. The SEC’s stance in 2025 leans toward treating certain crypto assets as securities, especially those tied to smart contracts or decentralized finance platforms. However, BTC’s status remains somewhat ambiguous due to its peer-to-peer network origins and lack of a central governing body. This uncertainty has led to volatility in trading volume, as investors weigh the risks of potential regulatory crackdowns.

Mining regulations have also become a hot topic, with environmental concerns driving policy changes. Countries like China (which banned mining in 2021) and the U.S. are now implementing carbon-neutral mandates for proof-of-work operations. Companies like MicroStrategy have responded by investing in renewable energy solutions for their BTC holdings, while miners are increasingly migrating to regions with cleaner energy grids. The Lightning Network, a layer-2 solution for faster and cheaper peer-to-peer transactions, has gained traction as a way to reduce the environmental footprint of Bitcoin transactions.

On the corporate side, BlackRock’s BTC ETF approval in early 2025 marked a turning point for institutional adoption, but it also came with stringent compliance requirements. Exchanges must now provide detailed technical analysis reports and adhere to anti-money laundering (AML) protocols. Even Satoshi Nakamoto’s vision of a fully decentralized currency is being tested, as governments push for more oversight. Some crypto purists argue this undermines Bitcoin’s original purpose, while others, like Arthur Hayes, believe regulation is inevitable for mass adoption.

Emerging trends like Bitcoin City in El Salvador and the rise of Bitcoin Cash as a scalable alternative show how the ecosystem is adapting. However, with market capitalization fluctuations and ongoing legal battles, navigating crypto regulations in 2025 requires a careful balance of innovation and compliance. Whether you’re a miner, trader, or long-term holder, staying informed about these changes is crucial for protecting your investments.

Professional illustration about Nakamoto

Scam Prevention

Scam Prevention in the Bitcoin Ecosystem: How to Stay Safe in 2025

With Bitcoin’s market capitalization surpassing $1.5 trillion in 2025 and adoption growing—from El Salvador’s legal tender status to BlackRock’s spot BTC ETF—scammers are also evolving. The decentralized nature of blockchain and peer-to-peer transactions makes cryptocurrency a prime target for fraud. Here’s how to protect your BTC investments and avoid common pitfalls.

Recognizing Common Bitcoin Scams

1. Fake Exchanges and Wallets: Scammers create clones of platforms like Binance or Coinbase, tricking users into entering private keys. Always verify URLs and enable two-factor authentication (2FA).

2. Ponzi Schemes: High-yield “investment” programs promising unrealistic returns (e.g., “double your BTC in a week”) often collapse, as seen with past proof-of-work mining scams. Stick to reputable entities like MicroStrategy for institutional-grade custody.

3. Phishing Attacks: Emails or messages impersonating Satoshi Nakamoto or influencers like Arthur Hayes may contain malicious links. Never share seed phrases or click unverified links.

4. Fake Giveaways: Celebrities or “official” accounts promising free BTC if you send a small amount first are always scams. Peer-to-peer networks don’t work that way.

Proactive Security Measures

- Verify Smart Contracts: Before interacting with decentralized finance (DeFi) protocols, audit contract addresses on Etherscan or similar tools.

- Monitor Trading Volume and Volatility: Sudden spikes in lesser-known tokens like Bitcoin Cash or Bitcoin City projects could signal pump-and-dump schemes. Tools like technical analysis indicators (RSI, MACD) help spot manipulation.

- Legal Compliance: Ensure platforms comply with local regulations. The SEC’s 2025 crackdown on unregistered cryptocurrency exchanges highlights the importance of due diligence.

Community and Education

Follow proof-of-work advocates and educators (e.g., Satoshi Nakamoto’s whitepaper, Arthur Hayes’ analyses) to stay updated. Platforms like Binance Academy offer free courses on store of value principles and scam red flags. Remember: If an offer seems too good to be true—like “digital gold” doubling overnight—it probably is. Stay skeptical, stay secure.

Professional illustration about Arthur

Bitcoin Halving

Bitcoin Halving: The Event That Reshapes Crypto Economics Every Four Years

The Bitcoin halving is one of the most anticipated events in the cryptocurrency world, occurring roughly every four years or after every 210,000 blocks mined. In 2025, the next halving will slash the block reward for mining from 3.125 BTC to 1.5625 BTC, further reducing the new supply entering the market. This built-in scarcity mechanism, designed by Satoshi Nakamoto, reinforces Bitcoin's reputation as digital gold—a store of value with a capped supply of 21 million coins. Historically, halvings have preceded major bull runs, as seen in 2012, 2016, and 2020, when reduced selling pressure from miners often coincided with increased demand.

Why the Halving Matters for Investors and Miners

For miners, the halving is a double-edged sword. While it underscores Bitcoin's deflationary nature, it also squeezes profit margins, especially for operations with high energy costs. Companies like MicroStrategy, which heavily invest in BTC, view halvings as long-term bullish events, as scarcity tends to drive price appreciation. Meanwhile, exchanges like Binance and Coinbase often see surges in trading volume around halvings, as traders speculate on volatility. The 2025 halving could be particularly impactful, given institutional involvement from firms like BlackRock, which now offers Bitcoin-backed financial products.

The Ripple Effects on the broader crypto Ecosystem

The halving doesn’t just affect Bitcoin—it sends shockwaves through the entire blockchain space. Decentralized finance (DeFi) platforms, for instance, may see increased activity as investors diversify into smart contracts-based yield opportunities. Projects like the Lightning Network, which aims to scale peer-to-peer transactions, could also gain traction as transaction fees rise post-halving. Even governments are paying attention: El Salvador, which adopted BTC as legal tender in 2021, might leverage the halving to promote its planned Bitcoin City, a tax-free crypto hub powered by geothermal mining.

Tactical Moves for Crypto Enthusiasts in 2025

For traders, the halving presents both opportunities and risks. Technical analysis often plays a key role, with historical patterns suggesting potential price floors and ceilings. However, the reduced trading volume in the months following the halving can lead to heightened volatility, requiring disciplined risk management. Long-term holders, on the other hand, might see the halving as a chance to accumulate, echoing the ethos of early adopters like Arthur Hayes. Meanwhile, forks like Bitcoin Cash serve as reminders that not all proof-of-work chains benefit equally from halving dynamics—liquidity and market capitalization remain critical factors.

Final Thoughts on the 2025 Halving Cycle

As the next halving approaches, the cryptocurrency community is buzzing with predictions. Will institutional adoption, led by players like BlackRock, offset miner sell pressure? Can innovations like the Lightning Network improve scalability enough to handle increased demand? One thing’s certain: the halving will test Bitcoin's resilience as both a peer-to-peer network and a global asset class. Whether you’re a miner, trader, or HODLer, understanding the halving’s mechanics is crucial for navigating the crypto landscape in 2025 and beyond.

Professional illustration about Bitcoin

Future of Crypto

The Future of Crypto: Bitcoin’s Evolution in 2025 and Beyond

Bitcoin continues to dominate the cryptocurrency landscape in 2025, solidifying its role as digital gold and a store of value amid global economic uncertainty. With institutions like MicroStrategy and BlackRock doubling down on BTC holdings, and countries like El Salvador expanding its use as legal tender, Bitcoin’s adoption is accelerating beyond speculation into real-world utility. The Lightning Network has matured, enabling faster, cheaper peer-to-peer transactions, while innovations in mining efficiency and renewable energy integration address long-standing sustainability concerns.

The rise of decentralized finance (DeFi) and smart contracts on Bitcoin’s blockchain—though slower than Ethereum’s ecosystem—is gaining traction, with projects leveraging proof-of-work security for new financial tools. Exchanges like Binance and Coinbase are adapting to regulatory shifts, offering institutional-grade custody solutions to meet demand from Wall Street. Meanwhile, Bitcoin City, El Salvador’s ambitious blockchain-powered metropolis, showcases how crypto can redefine urban economies, though skeptics question its scalability.

Volatility remains a challenge, but sophisticated technical analysis tools and hedging products (like Bitcoin futures) help traders navigate price swings. Bitcoin Cash and other forks struggle to compete, as the original peer-to-peer network envisioned by Satoshi Nakamoto proves more resilient. Visionaries like Arthur Hayes predict Bitcoin’s market capitalization could surpass gold’s as generational wealth shifts toward crypto—especially with younger investors favoring digital assets over traditional banks.

Key trends to watch:

- Institutional adoption: BlackRock’s spot Bitcoin ETF and corporate treasuries (like MicroStrategy’s) signal long-term confidence.

- Regulation: Clearer frameworks in the U.S. and EU could reduce trading volume fluctuations and attract mainstream investors.

- Technology: Layer-2 solutions (e.g., Lightning) and sidechains aim to solve scalability without compromising decentralization.

- Global adoption: Developing nations using Bitcoin for remittances and inflation hedging could drive the next wave of growth.

Despite competition from altcoins, Bitcoin’s proof of work consensus and finite supply (capped at 21 million coins) keep it at the forefront of the cryptocurrency exchange ecosystem. Whether as a hedge against fiat devaluation or a foundation for peer-to-peer network innovation, Bitcoin’s future hinges on balancing decentralization with real-world utility—a challenge that will define crypto’s next decade.

Professional illustration about Bitcoin

Bitcoin vs Altcoins

Bitcoin vs Altcoins: Understanding the Key Differences in 2025

The cryptocurrency landscape in 2025 continues to evolve, but Bitcoin (BTC) remains the undisputed leader in terms of market capitalization, store of value, and institutional adoption. While altcoins—alternative cryptocurrencies like Bitcoin Cash, Ethereum, or Solana—offer unique features such as smart contracts or faster transactions, Bitcoin’s dominance stems from its first-mover advantage, decentralized peer-to-peer network, and widespread recognition as digital gold. Companies like MicroStrategy and BlackRock have doubled down on BTC as a hedge against inflation, while nations like El Salvador still recognize it as legal tender.

One of Bitcoin’s strongest arguments against altcoins is its proof-of-work consensus mechanism, which ensures security and decentralization. However, this comes at a cost: mining BTC requires significant energy, a criticism altcoins like Ethereum have addressed by shifting to proof-of-stake. Yet, Bitcoin’s Lightning Network has mitigated scalability issues, enabling faster peer-to-peer transactions at lower fees—something Bitcoin Cash initially promised but failed to deliver at the same scale.

When it comes to trading volume and liquidity, Binance and Coinbase still show BTC dominating pairs against altcoins. Traders often use BTC as a benchmark for technical analysis, given its lower volatility compared to smaller altcoins. For example, while Arthur Hayes, former CEO of BitMEX, has speculated on altcoin rallies, he consistently emphasizes BTC’s long-term store of value proposition.

Decentralized finance (DeFi) platforms have fueled altcoin growth, but Bitcoin’s simplicity—rooted in Satoshi Nakamoto’s original vision—keeps it resilient. Projects like Bitcoin City, El Salvador’s planned crypto hub, further cement BTC’s real-world utility. Meanwhile, altcoins often struggle with regulatory scrutiny or fading hype cycles.

So, which is better? It depends on your goals. If you seek stability and institutional backing, Bitcoin is unmatched. But if you’re chasing innovation in blockchain tech, altcoins offer niche solutions—just be prepared for higher risk. The key is diversification: many portfolios in 2025 balance BTC’s reliability with select altcoins’ high-reward potential.